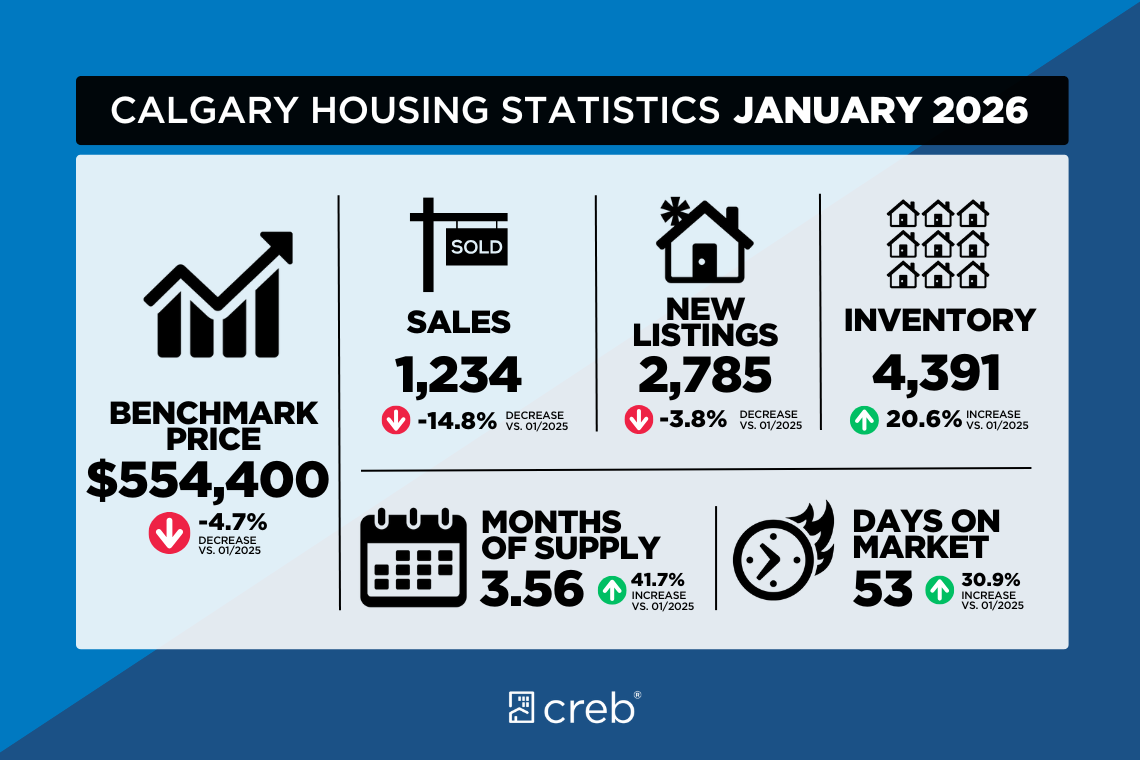

Calgary reported 1,234 sales in January, a year-over-year decline of 15%, but in line with typical levels of activity for the month. While sales declined across all property types, the steepest declines occurred in higher-density homes.

“Following the typical December slowdown, potential buyers for high-density homes were more hesitant to return to the market in January, as increased supply choice across all aspects of the market has reduced the sense of urgency,” said Ann-Marie Lurie, CREB®’s Chief Economist. “At the same time, sellers were quick to bring their listings onto the market, causing the sales-to-new-listings ratio to drop to 44%, mostly due to shifts in apartment and row-style homes. Overall, this is not entirely uncommon for January, as both buyers and sellers weigh their options ahead of the spring market.”

The rise in new listings compared to sales caused inventory levels to increase to 4,391 units, the highest January level since 2020. However, as with sales, conditions vary by property type, with row and apartment homes facing higher levels of inventory compared to long-term trends. The result is months of supply that ranges from under three months in the detached sector to five months for apartment-style homes.

Due to declines in the later part of 2025, benchmark prices are lower than levels reported at the start of last year. However, seasonally adjusted figures point to stable levels in January compared to the end of 2025. Nonetheless, year-over-year total residential benchmark prices have declined by nearly 5%, as steep declines reported in the oversupplied row- and apartment-style homes weighed on total residential prices compared to last year.

Housing Market Facts

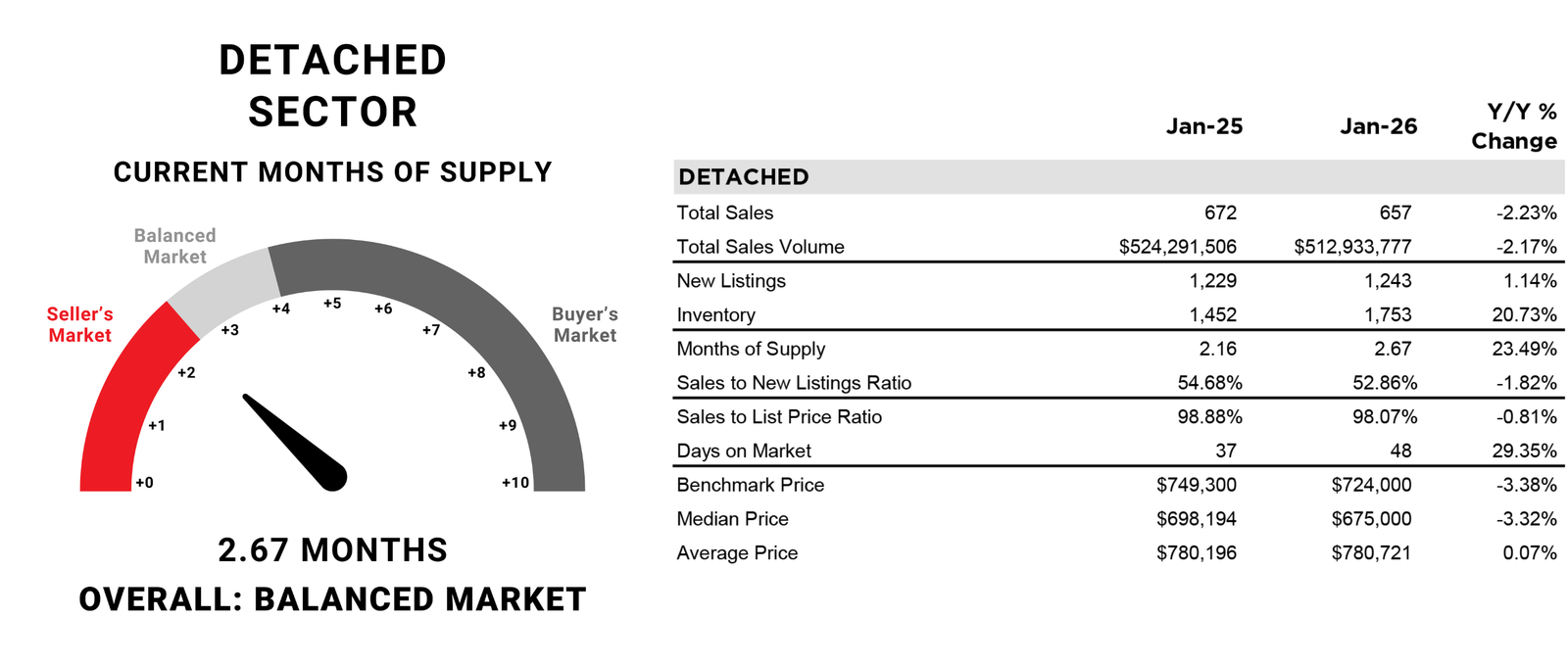

DETACHED

There were 657 sales and 1,243 new listings in January, comparable to levels reported last year. However, new listings did rise over December levels, causing inventories to reach 1,753 units, just shy of long-term averages for the month. With less than three months of supply and a sales-to-new-listings ratio of 53%, conditions remained relatively balanced in the detached market.

The January unadjusted benchmark price was $724,000, slightly lower than the previous month and over 3% lower than last January, as prices trended down over the second half of 2025. Price movements varied throughout the city, with year-over-year declines ranging from less than 1% in the West district to over 6% lower in the North East. While unadjusted prices did ease over December, this was mostly due to pullbacks in the City Centre and North West districts.

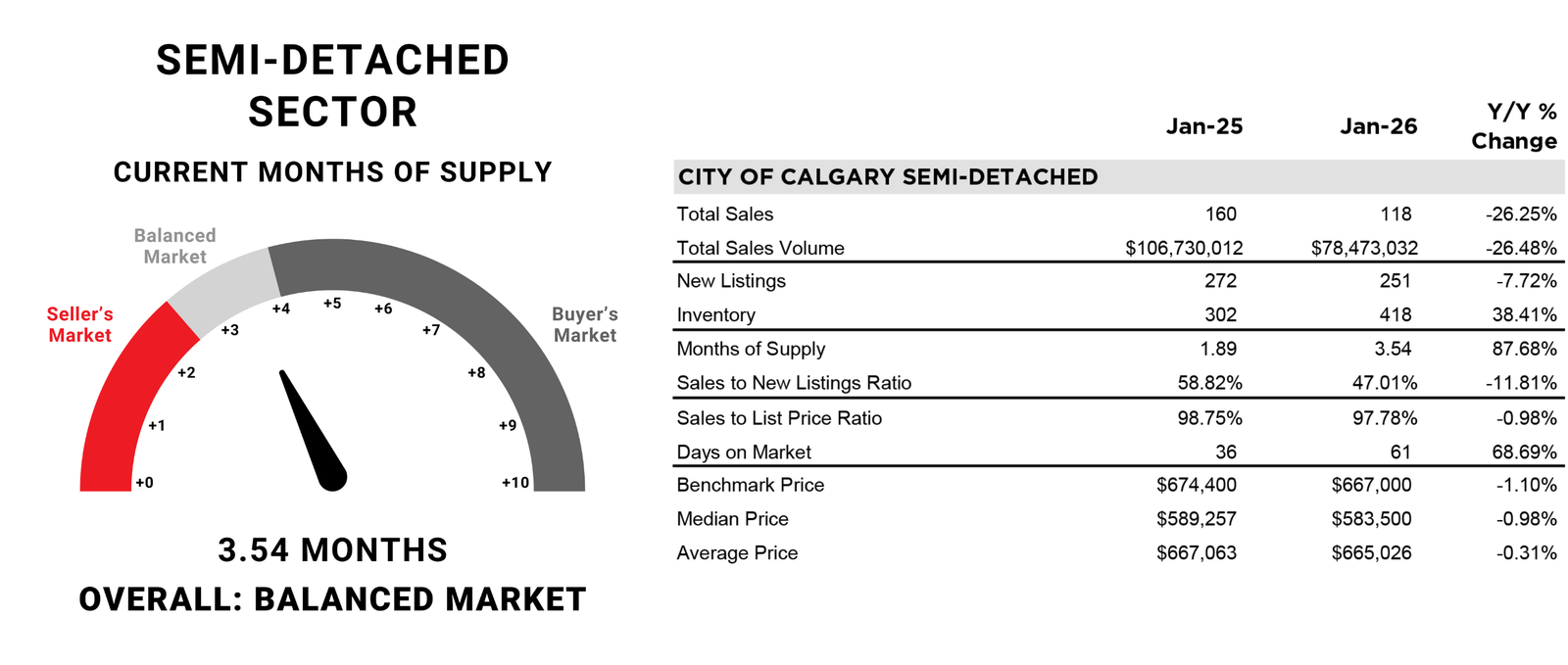

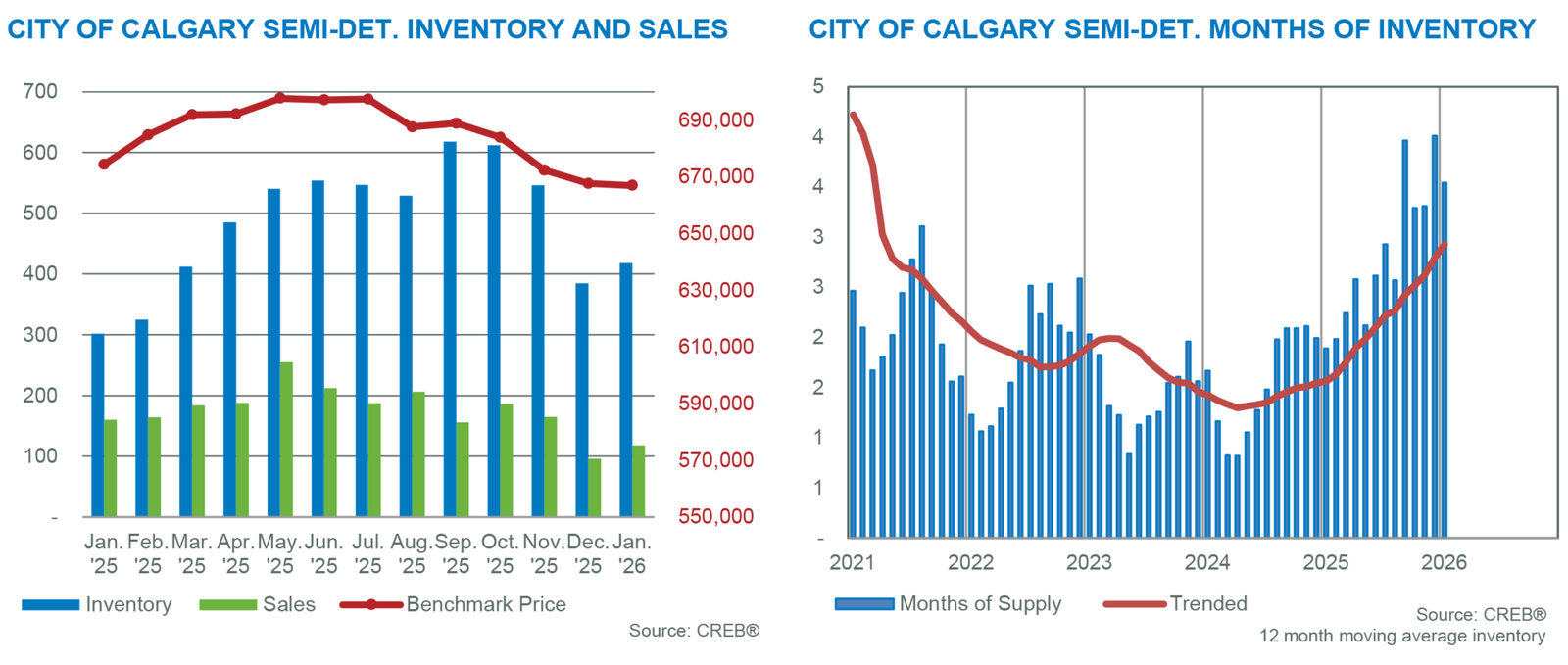

SEMI-DETACHED

There were 118 sales in January and 251 new listings, representing 10% of the market activity in the city. While both sales and new listings improved over December, the growth in new listings was higher, causing the sales-to-new-listings ratio to ease to 47%. Inventory levels improved but conditions remained relatively balanced, with three and a half months of supply.

Rising supply, which started in the latter part of 2025 and continues into 2026, is creating more price stability. As of January, the benchmark price was $667,000, similar to last month and only 1% lower than last January. Year-over-year prices in both the North West and West districts remain higher than last year but are lower in every other district.

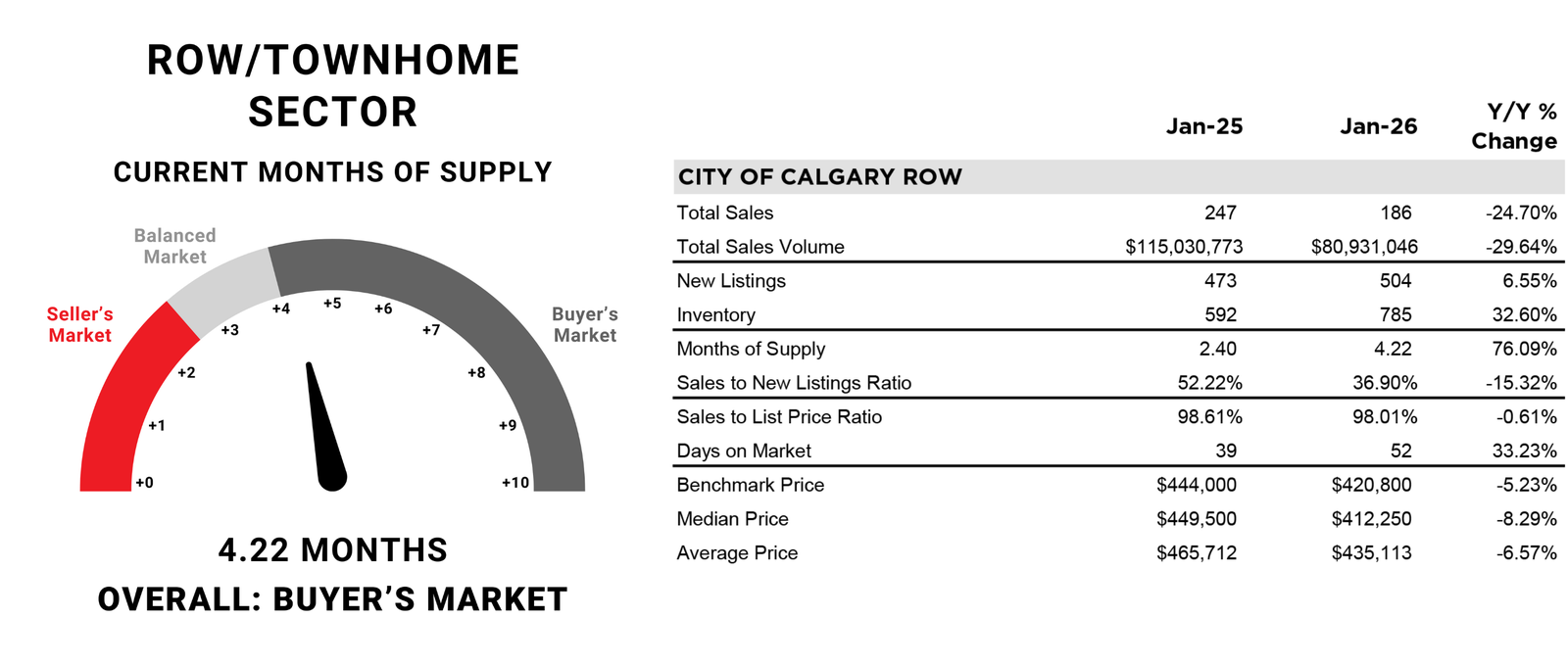

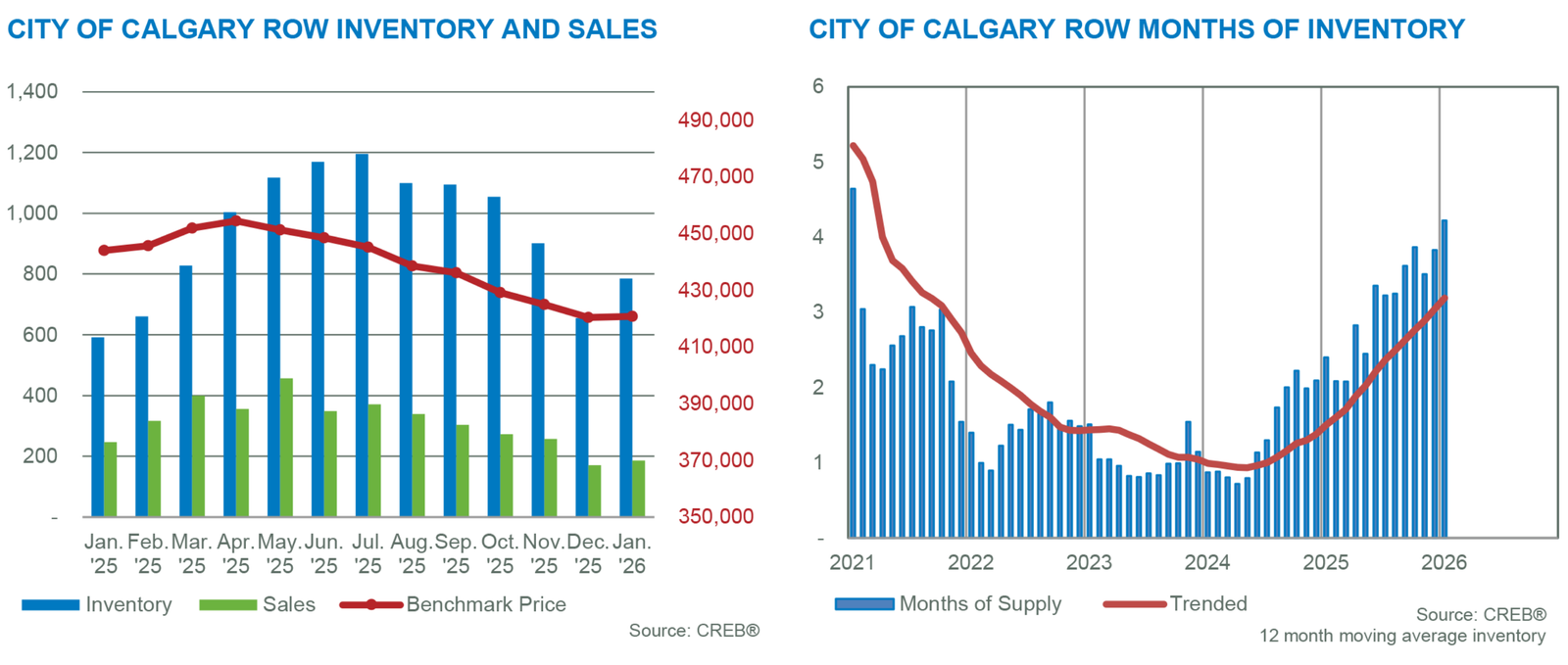

TOWNHOME/ROW

There were 186 sales in January, down by nearly 25% compared to last year. Meanwhile, supply continued to rise both in terms of new listings and inventory growth, causing the months of supply to push above four months.

Despite the added supply, the unadjusted benchmark price remained similar to December's levels, but was 5% lower than last January. The month-over-month stability was due to gains in the City Centre and West districts. Year-over-year price adjustments have been the highest in the North East and East districts, followed by the North and South East districts, which have faced significant competition from the new-home market.

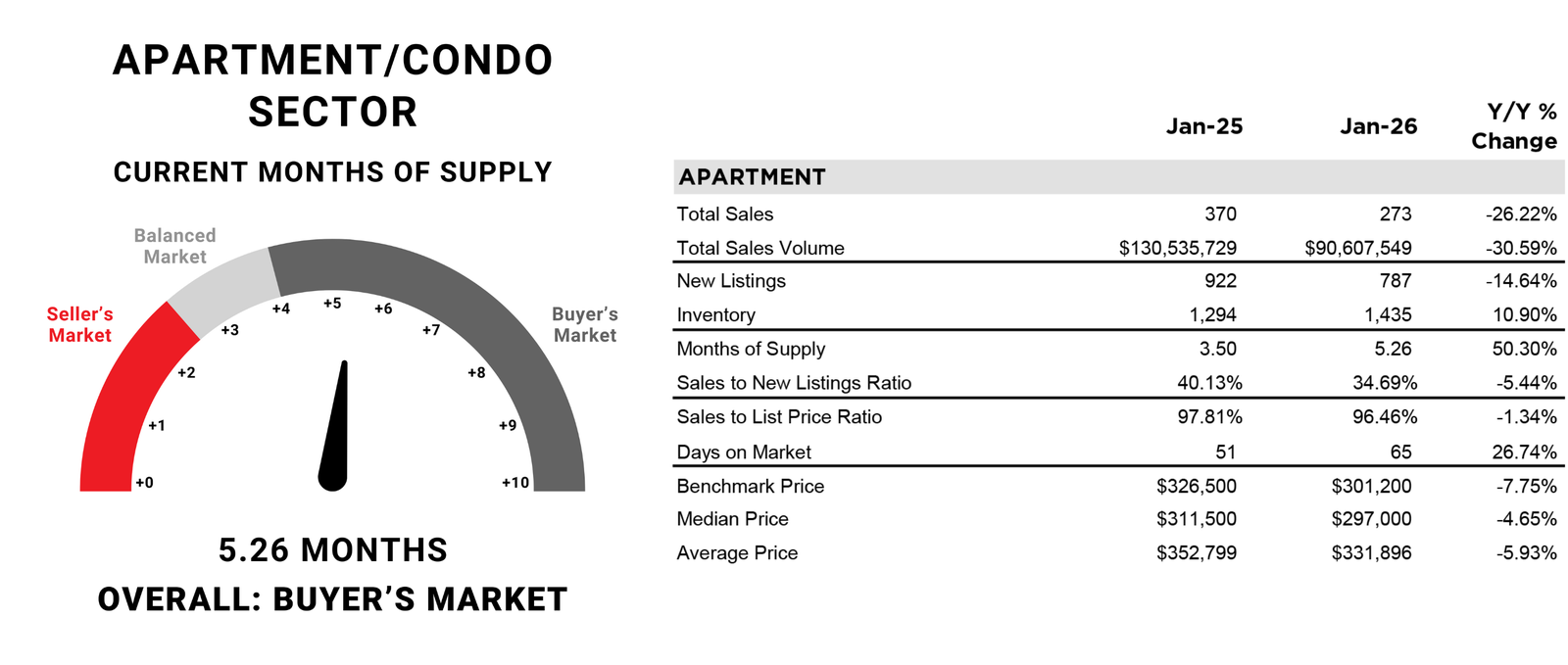

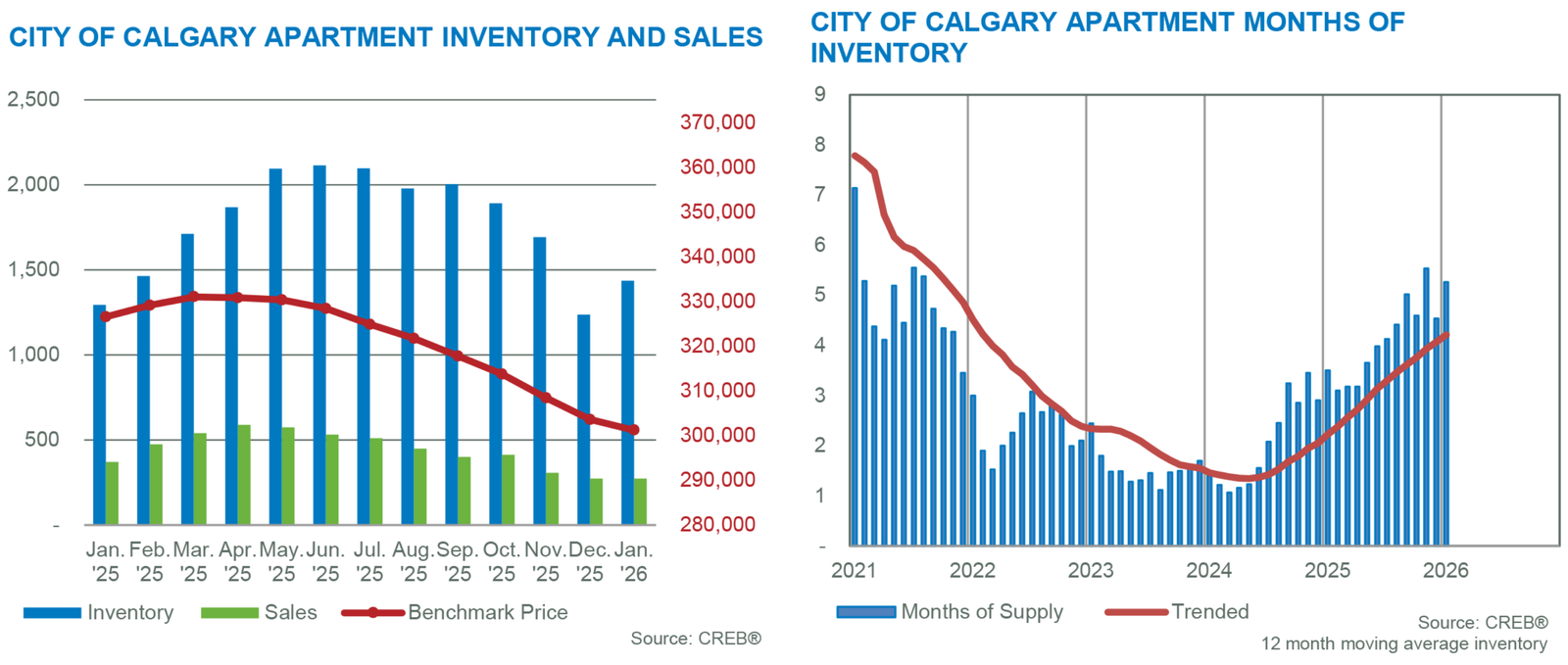

APARTMENT/CONDO

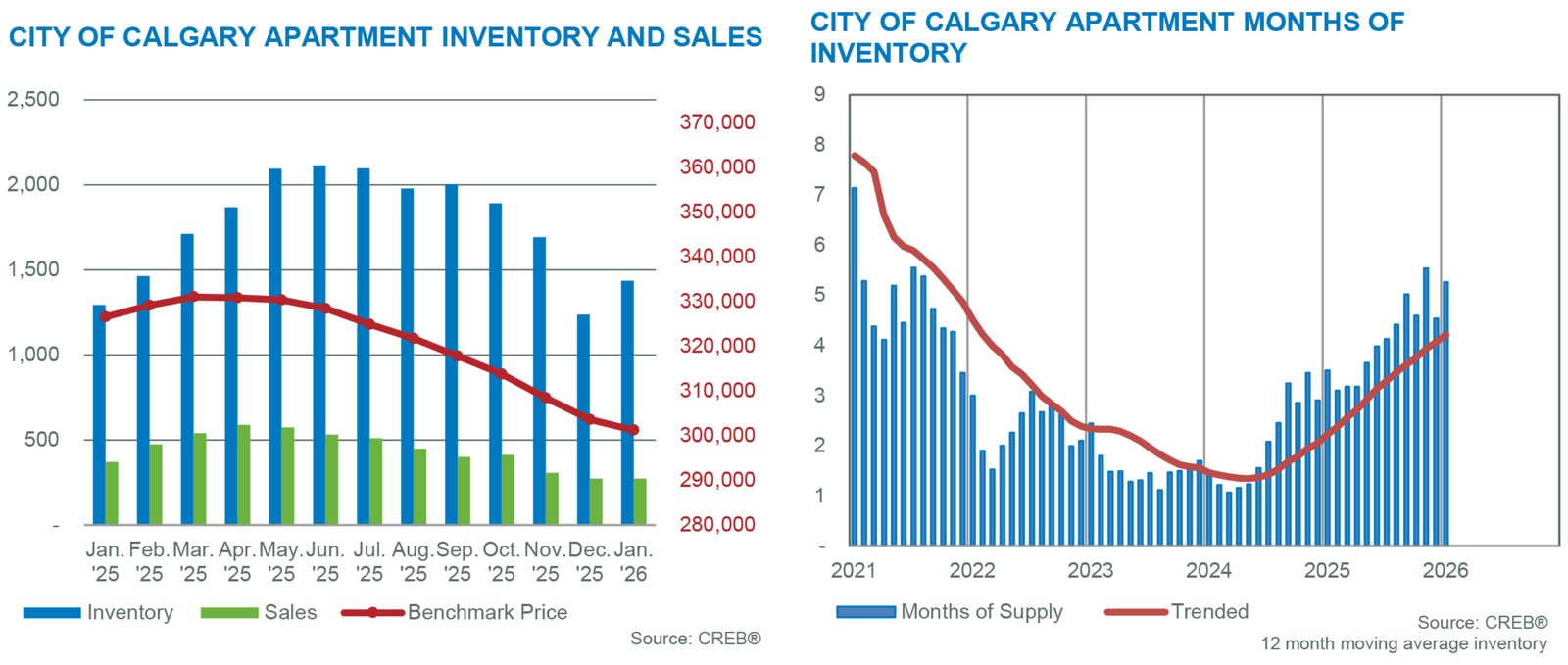

Apartment-style units continue to struggle with supply. New listings reached 787 units, which is not as high as last year but a significant jump over December and much higher than the 273 sales reported in January, pushing the sales-to-new-listings ratio down to 35%. This drove further gains in inventory, which reached 1,435 units, the highest levels ever reported for January.

With over five months of supply in January, it is not surprising that prices trended down further. The unadjusted benchmark price was $301,200, nearly 1% lower than the previous month and 8% lower than last January. Prices have been falling across every district, with year-over-year declines ranging from 13% in the North East to 6% in the City Centre.