The Calgary Real Estate Board (CREB®) recently released the 2026 Forecast Calgary and Region Yearly Outlook Report. This comprehensive report, prepared by CREB® Chief Economist Ann-Marie Lurie, provides an in-depth analysis of Calgary's economic and housing market trends for the upcoming year.

Here is a look at what CREB says about the Calgary economy. If you are looking for insights into the Calgary real estate market, visit our sister post: CREB 2025 MARKET SUMMARY & 2026 FORECAST

2025 Forecast Summary

CALGARY HOUSING MARKET

In 2025, housing market activity in Calgary transitioned from one that favoured the seller to more balanced conditions as improving supply in the new home, rental and resale markets occurred just as demand returned to more typical levels, mostly due to slower migration levels. This took much of the pressure off home prices, especially in the apartment and row segments, which reported the largest gains in supply compared to long-term trends.

Market Shifts in 2026

As we move into 2026, supply levels are expected to remain elevated for higher density homes, as 2025’s record high starts will continue to add supply to the rental and new home market as those units are completed. The elevated inventory levels should cool new home starts this year, taking the pressure off supply growth by the end of 2026 and into 2027.

Previous population gains and job growth are expected to keep sales in line with long-term trends. But no further uptick in demand is expected given the shift in migration and employment in the city.

The recent MOU regarding new pipeline development and shifts in regulatory policy, signed by the provincial and federal government, provides significant upside for our city and province should progress be made. However, the economic benefits would not be expected to influence the housing market this year. Elevated supply across new, resale and rental markets, combined with stable demand, is expected to prolong the time it takes to absorb the additional resale supply currently in the market.

PRICE VARIATIONS FOR 2026

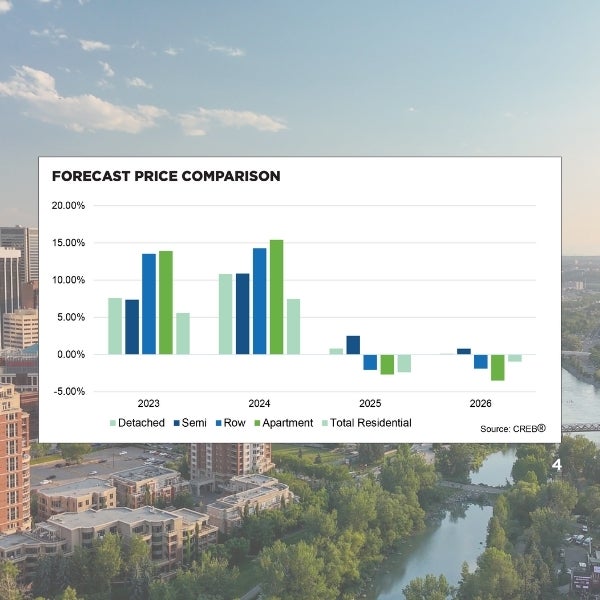

Overall, balanced to buyer’s market conditions are expected to persist in 2026 depending on the property type. The additional supply in the apartment and row segments of the market are expected to weigh on resale prices in those segments.

Stable Prices for Detached and Semi-Detached Homes

Meanwhile, annual prices should stabilize in the more balanced detached and semi-detached segments.

Lower Prices for Apartments and Townhomes

Nonetheless, further annual price declines for apartment and row-style homes will continue to weigh on total residential prices, which are expected to ease slightly over last year.

Calgary Property Types

DETACHED

Heightened uncertainty, lower migration numbers and added competition from the new home market contributed to slower than expected sales in the detached market this year. At the same time, resale supply levels improved, creating more balanced conditions and slowing the pace of price growth. Prices did trend down over the later part of the year, but not enough to offset earlier gains, as annual prices rose slightly over 2024’s levels.

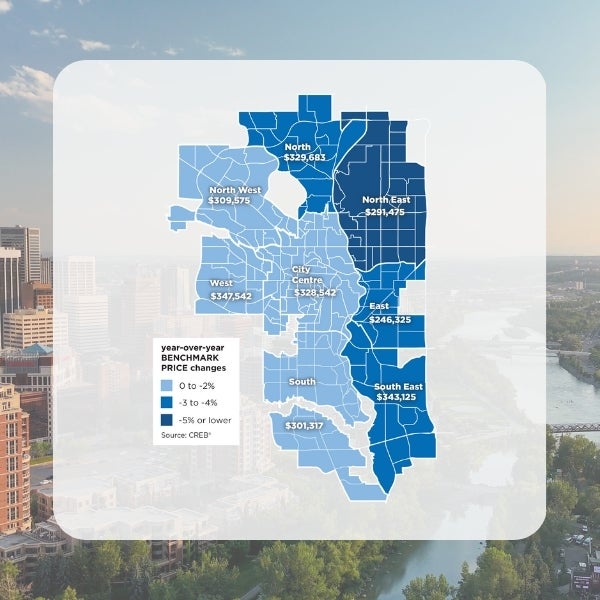

However, much of the price adjustment that occurred was in the North East, North and East districts. This in part is related to the additional supply choice coming from the new home market, which is drawing some purchasers away from resale homes. On an annual basis, price adjustments ranged from an annual gain of three per cent in the City Centre to a decline of nearly two per cent in the North East. Sales are expected to remain at similar levels in 2026 compared to last year as the economy continues to adjust to slower migration and job growth. At the same time, supply choice in all aspects of the market will keep conditions on the higher end of the balanced scale. This is expected to prevent any significant change in detached prices this year.

KEY FACTORS INFLUENCING 2026

- Economic Context

More supply choices from the new home market and the current employment state of the city should balance the market.

- Population Growth

- Market Segmentation

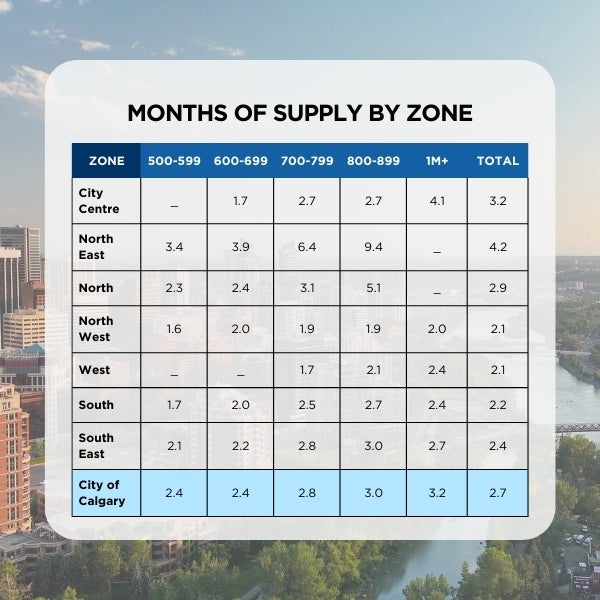

SEMI-DETACHED

Semi-detached homes represent the smallest share of overall market activity at just nine per cent of all inventory and sales in the resale market. Unlike rowand apartment-style units, semi-detached homes also represent a smaller share of total construction activity compared to the past decade. While new starts did improve this year, the pace of growth was much slower than the higher-density row- and apartment-style units. This likely prevented semi-detached resale inventories from rising to the near record and record-high levels reported for row- and apartment-style homes. However, rising new listings and slightly slower sales did cause inventories to increase to levels more consistent with long-term trends, supporting more balanced conditions by the last four months of the year. While there were some typical seasonal price adjustments in the latter part of the year, thanks to relatively tight conditions throughout the spring, on an annual basis prices rose by nearly three per cent, which was in line with expectations for this segment. Conditions do vary significantly by price range and location.

Nearly 30 per cent of the supply of semi’s are located in the City Centre, where units priced over $1,000,000 are experiencing higher supply/demand ratios and conditions favour the seller for lower priced units. This variation is likely resulting in some pockets of the market experiencing price reductions while other pockets continue to report price growth. As we move through 2026, additional supply choice for competing new and resale row homes will slow semi-detached home sales to levels that are more consistent with long-term trends. At the same time, improved supply for competing properties will prevent any significant shift in semi-detached prices.

KEY FACTORS INFLUENCING 2026

- A Shift Toward Balance

- Supply Growth

- Price Stabilization

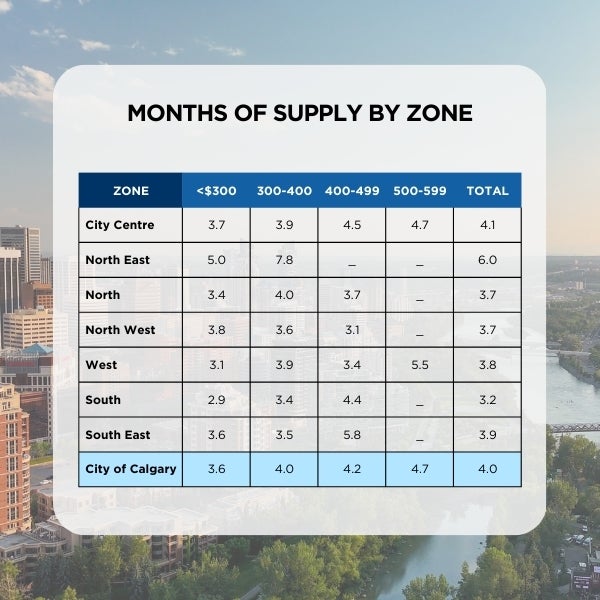

ROW/TOWNHOMES

Like apartment-style units, row homes reported a decline in sales in 2025, but remained higher than levels reported prior to 2021. However, this segment of the market also reported record-high new listings in 2025, causing inventories to rise to levels not seen since 2019. Rising supply choice was also seen in the new home sector, thanks to record-high starts occurring over the past few years. Inventories for row homes improved across all areas of the cities, but doubled in the North East, North, North West, South East and East districts.

The largest impact on row prices occurred in the North East and North districts, which reported annual price declines around four per cent. Overall, the benchmark row prices reported an annual decline of two per cent compared to 2024. As we move into 2026, supply pressure in this segment is expected to continue, placing further downward pressure on resale prices. The higher prices of newer properties should keep the resale product competitive, slowing the pace of supply growth in 2026. However, it will take some time to work through the additional supply in some pockets of the resale market, weighing on row prices. Overall, prices are still expected to decline in 2026, albeit at a slightly slower pace than what was experienced in 2025.

.

.

KEY FACTORS INFLUENCING 2026

- Easing Price Pressures

- Continued Price Adjustments

- Competitive Resale Advantage

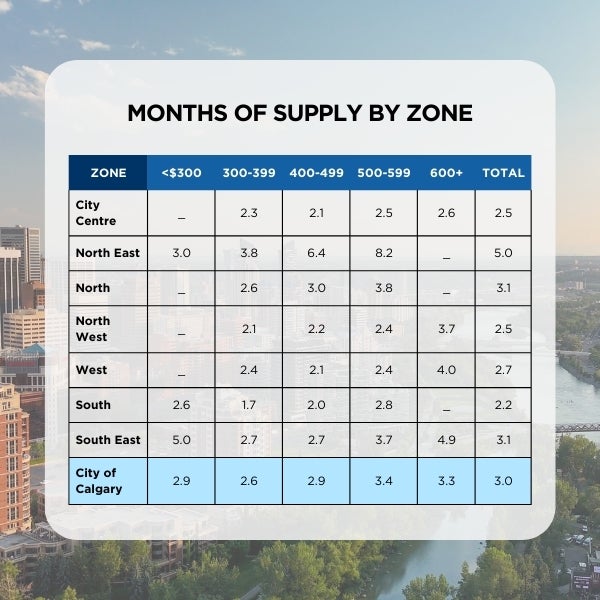

APARTMENT

Limited supply choice and tight rental markets drove strong sales activity for apartment-style condos througout 2022 to most of 2024. By the end of 2024, conditions started to shift. Record-high new construction levels over the past several years caused both rental and new condo supply growth to improve. Additional rental supply and easing rental rates both slowed the transition to ownership, and additional new home supply pulled some of the demand away from the resale market toward new product.

Resale sales activity totaled 5,426 in 2025, down by 29 per cent compared to the high levels reported in 2024. While sales remained better than anything reported before 2022, they started to slow as new listings remained elevated, causing inventories to reach record highs. This rising supply of new, resale and rental product weighed on resale prices throughout most of the year and by the end of 2025 were eight per cent below their peak levels of 2024. On an annual basis, prices in 2025 were down by nearly three per cent compared to 2024. Prices declined across most districts, but the largest annual declines occurred in the North East, North, South East and East. In the City Centre, where 43 per cent of the apartment inventory is located, prices were only down by two per cent on an annual basis.

With rental vacancies expected to remain elevated in 2026 and further supply growth expected due to new constructon completions, we anticipate that excess supply of apartment-style units will persist in 2026, driving further price reductions.

.

.

KEY FACTORS INFLUENCING 2026

- Slow Transition from Renting to Owning

High rental vacancies will most likely persist in 2026, tightening the pool of active resale buyers.

- Supply Surge

- Price Drops