The Calgary Real Estate Board (CREB®) has released its spring 2025 housing market update, an overview of the state of the real estate landscape in Calgary and surrounding areas. The report updates the forecast for 2025 that CREB® released in January, highlighting trends in sales, pricing, the economic forces that are currently affecting the market, and how they may shape activity for the rest of the year.

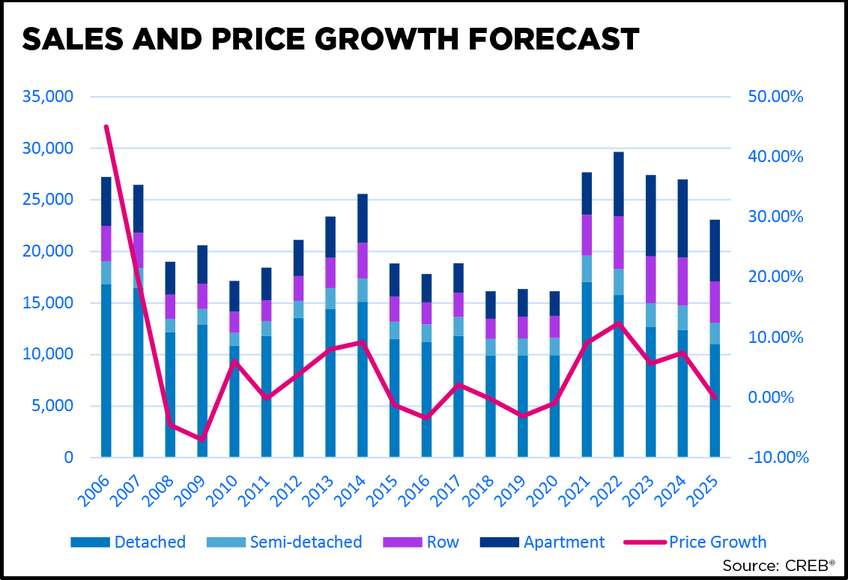

Sales activity so far this year has eased more than expected as economic uncertainty has weighed on consumer confidence. However, this easing comes from a relatively high starting point and has brought sales to a level that is more consistent with long-term trends and higher than the lows reported during the economic slowdown of 2015 -2019.

Meanwhile, record high new home starts over the past few years are contributing to supply gains. Most of this supply is higher density in nature and targeted to the rental market, but is still causing inventory to rise in the resale market as renters and buyers have more options. This has contributed to the doubling of inventory over 2024, which is bringing resale supply back in line with normal levels.

“Uncertainty has weighed on housing sales at a time when supply levels are rising, creating much concern over a market correction. However, context is needed as we are moving from a market that favoured sellers for most of the past three years, to one that is more balanced and, in some cases, favouring buyers,” says Ann-Marie Lurie, CREB®’s Chief Economist and author of the report.

“More supply choice in resale, new homes and rental markets is taking pressure off home prices, but not in a uniform manner across the city, and not enough to offset the multiple years of double-digit growth.”

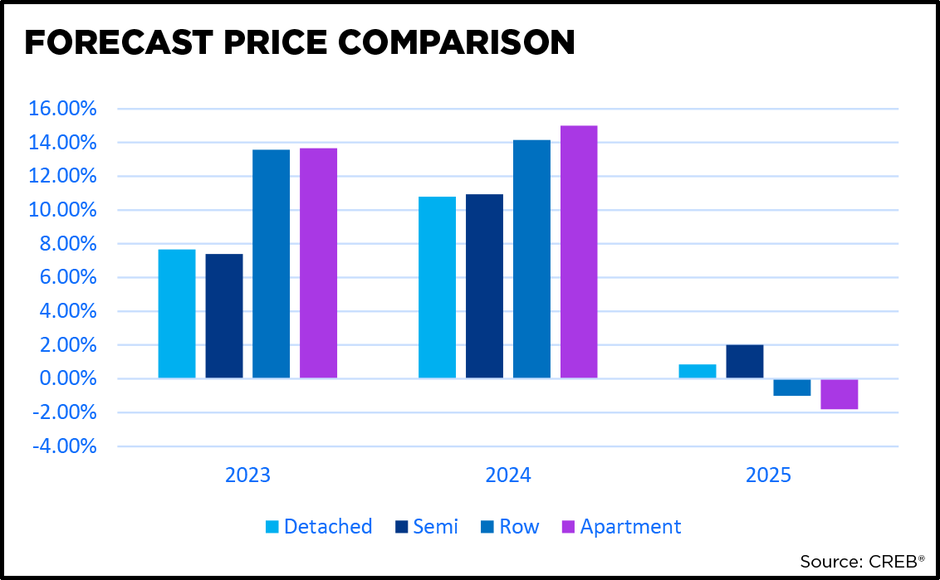

Additional higher-density supply relative to demand is expected to weigh on prices for apartment and row style homes, with annual declines of two percent expected for apartment style properties and one percent for row homes in 2025. Meanwhile, detached home prices are expected to remain relatively stable as price growth in locations with limited supply are expected to offset the declines occurring in pockets of the market that facing rising competition from new homes.

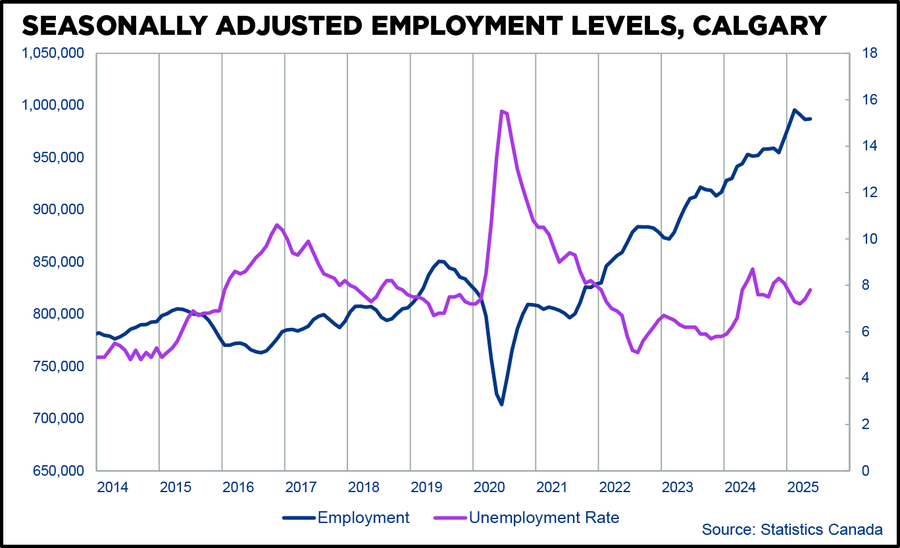

While uncertainty risk remains over the short term, supportive population growth in Calgary and resiliency in the city’s job market are helping prevent a more severe outcome in our market. Moving forward, clarity surrounding energy/environmental policy will be an important factor influencing the housing market beyond 2025.

Spring Update

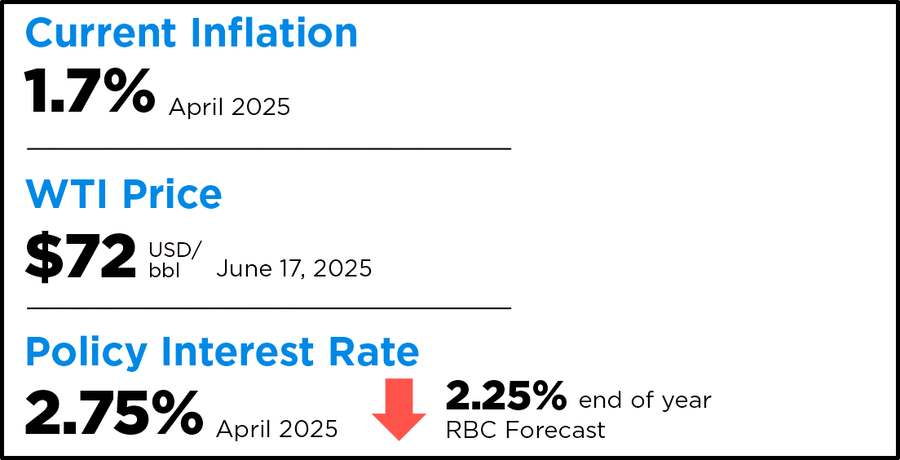

Since the Calgary and region forecast for 2025 was released, economic uncertainty has continued to persist. While much of the most punitive tariffs on Canada have been on aluminum and steel, rising global tariffs have elevated uncertainty regarding energy prices, the impact on inflation and the overall economy. Alberta is expected to lead the country in growth this year, as we are not facing the same near-term challenges experienced in provinces that are more directly impacted by the tariffs. However, we are not immune to the volatility facing the global economy, which is impacting oil prices, creating uncertainty and affecting consumer and business investment.

Trade and economic uncertainty has contributed to slower sales in many housing markets across the country, including Calgary. Here, earlier declines in energy prices combined with uncertainty regarding energy policies and a pause in rate declines likely also contributed to some of the stronger than expected pullback in activity in the early spring market. However, supportive population growth along with previous gains, resiliency in our job market and lower lending rates in the second half of the year should help offset some of the impact on demand felt throughout the spring.

Sales in Calgary were forecasted to ease slightly in 2025. However, the heightened uncertainty throughout the spring months is expected to result in a higher than expected decline in annual sales. While sales are not expected to ease to the lower levels reported during the 2015-2020 period, sales are expected to slow to levels more consistent with long-term trends.

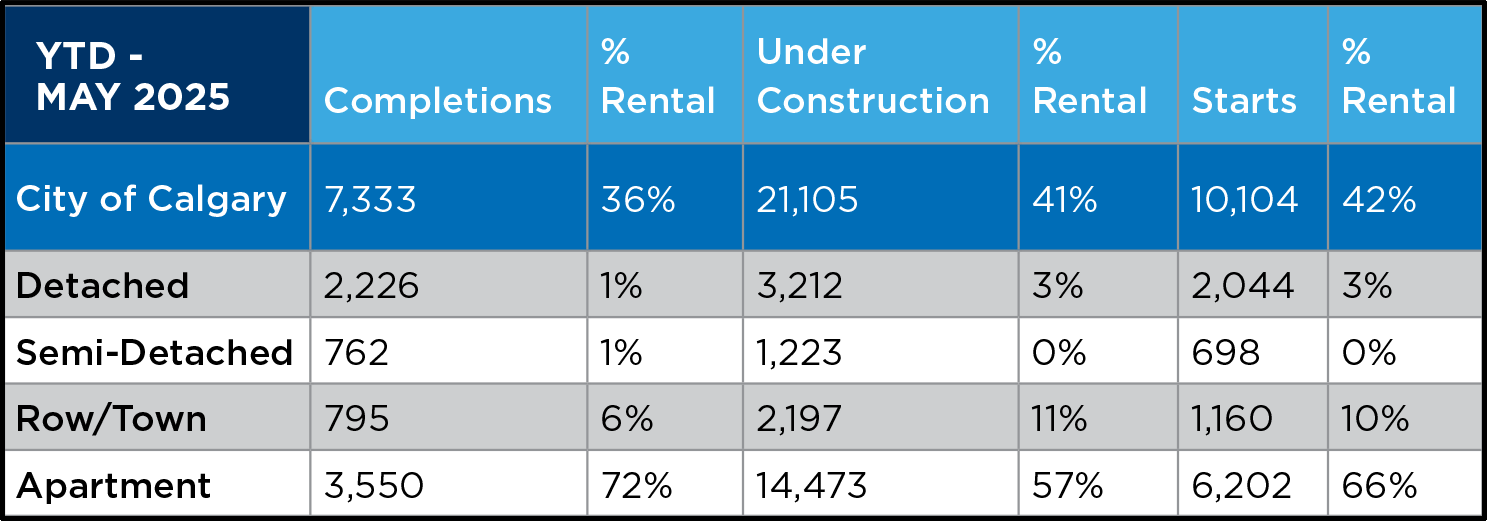

At the same time, record high starts occurring over the past few years are adding supply to the market. Most of this supply is higher density in nature and targeted to the rental market. Nonetheless, as these units are completed, the additional supply choice for renters, potential owners and existing homeowners is causing supply to rise in the resale market. However, like sales, the inventory gains need perspective. While inventory has doubled over last year’s levels, they are rising from near record lows, and inventory levels are returning to normal levels.

Easing sales combined with rising inventory are expected to support more balanced conditions in our housing market, a significant change from the extreme seller’s market conditions experienced over the past two years. This will take much of the pressure off home prices, which are expected to be relatively stable this year, compared to the modest growth that was previously expected. However, conditions will vary by property type as the detached market still struggles with supply growth in some price ranges, supporting modest price gains. Meanwhile, additional supply growth for apartment and row style units is expected to place some downward pressure on prices in those sectors.

Key Economic Indicators

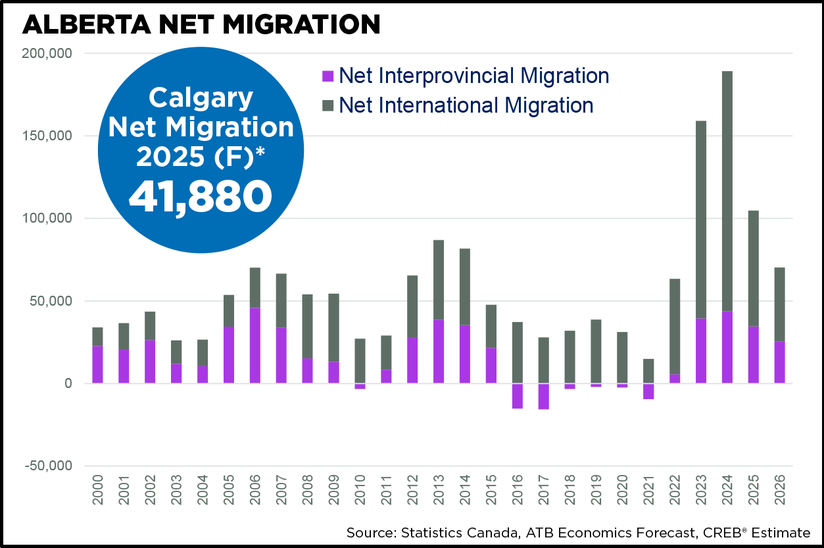

Expectations of Alberta's and Canada's economic performance this year remain wide ranging. Policy interest rates are still expected to ease, as weaker economic activity is expected to offset the impact of inflationary pressures caused by the tariffs. Meanwhile, provincial migration levels are expected to slow from the rapid pace seen over the past two years, but remain in a range that still supports housing activity. While risk and uncertainty remain high, outcomes and the impact on housing demand will be largely contingent on whether we continue to avoid significant job loss and the direction of energy/environmental government policy.

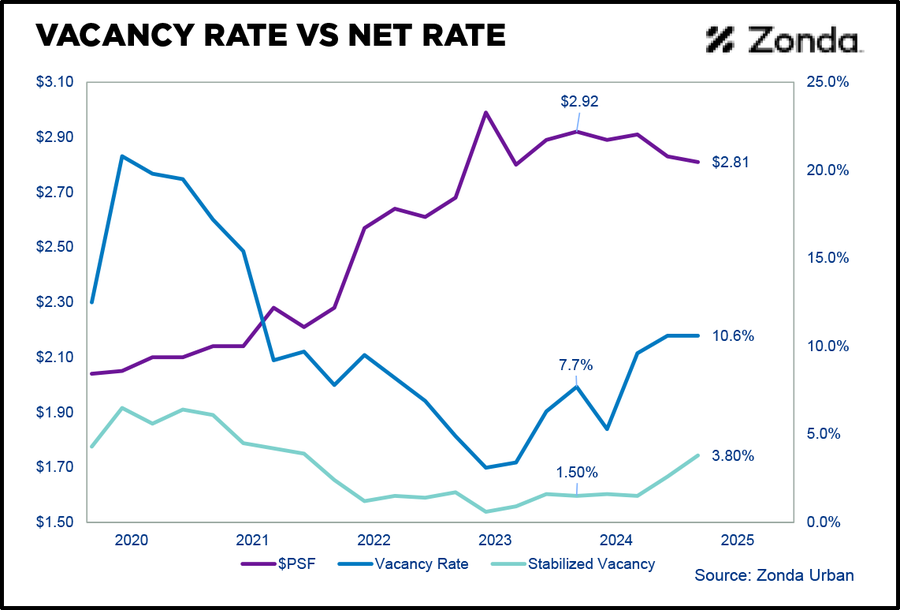

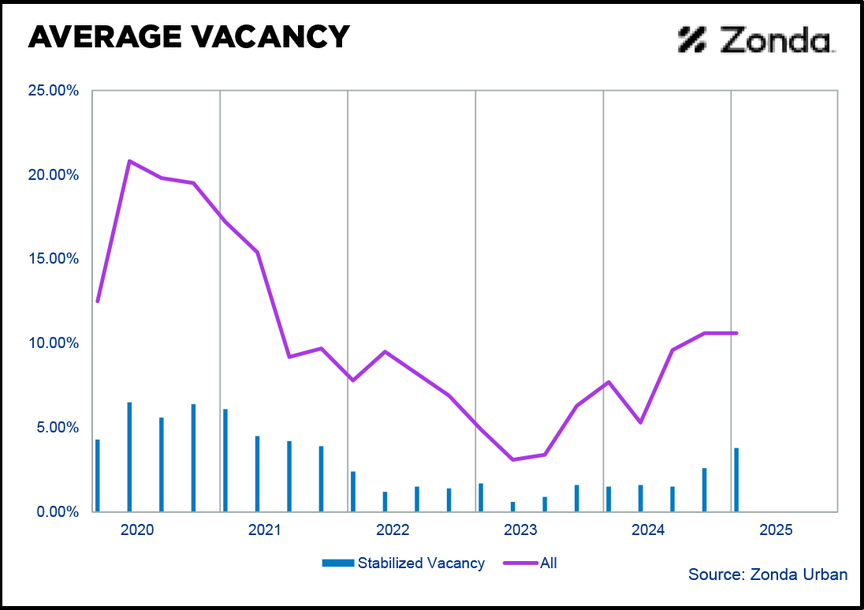

New Construction & Rental Market

Following the record-high starts of last year, new home starts continue to rise. However, much of the starts in Calgary are higher-density products intended for the rental market. This will continue to support the trend of higher rental vacancies and declines in asking rents. Gains in higher density construction are expected to weigh on resale condominium and row product, as more supply choice for renters tends to slow demand for ownership both from renters and investors, especially as international migration numbers ease from record high levels. Rising supply choice is mostly occurring in the newer communities of the city, impacting resale prices in areas within close proximity to newer homes.

Housing Market

DETACHED

Sales for detached homes slowed compared to last year, while new listings have been on the rise. Much of the gain in new listings has been driven by homes priced above $600,000, contributing to a rise in inventory. However, inventory remains low based on historical standards and future supply growth will be somewhat limited with a larger share of the new construction dedicated to higher density homes.

Rising inventory and easing sales have helped shift the market toward more balanced conditions. Citywide there was just over two months of supply, low enough to support further price growth, but at a pace that is slower than what was experienced last year at this time. Citywide conditions are more balanced in the upper end of the market, but remain relatively tight for homes priced below $700,000. However, conditions do vary by location and price range with some pockets of the market facing buyer’s market conditions while others remain firmly in seller’s market territory.

The additional supply choice is having a more significant impact in the North East and North districts. This is especially true for homes priced above $700,000 in the North East, and homes over $800,000 in the North. Increased competition from new product and narrowing price spreads between new and resale properties are likely preventing much if any price growth in these segments. Meanwhile, detached homes in some districts are still in short supply, supporting further price gains. Citywide prices are expected to remain just slightly higher than last year’s levels, as pullbacks in some areas will be offset by gains in others.

SEMI-DETACHED

Like other property types, semi-detached homes reported a pullback in sales alongside a rise in new listings and inventory levels. This has helped the market move toward more balanced conditions and slowed the pace of price growth compared to the double-digit growth reported last spring. Benchmark prices in May reached $697,300, up over the previous month, nearly three per cent higher than last year’s levels and above the peak price reported last year.

Semi-detached sales represent only nine per cent of all activity in the city, and only eight per cent of all inventory. The City Centre accounts for the largest share of inventory at over 30 per cent, with 90 per cent of the City Centre’s inventory priced above $800,000. Within the City Centre we are starting to see a 40 per cent sales-to-new-listings ratio for homes priced above $1,000,000, driving inventory gains and likely impacting price growth in that segment. Like other property types, changes to inventory are not equal across the city and price movements ultimately will vary depending on location and price range.

ROW/TOWNHOME

Over the past three years, row home sales have accounted for a larger share of the sales activity in the city, accounting for 17 percent of all sales, compared to the historical average of 13 percent. Unlike semidetached properties, row home sales are distributed relatively equally across most districts in the city, with a slightly higher share in the North, South and South East districts where there is a higher share of newer communities. Like apartment style activity, row sales have eased over last year’s levels but remain well above levels reported during the previous downturn in our economy. However, significant growth in new listings and inventory levels have driven the market to shift toward more balanced conditions. With over two months of supply in May, the pace of price growth has slowed for row homes. The resale benchmark price was $453,600 in May, nearly two percent lower than last year and below peak prices reported in June of 2024.

Inventories have been rising across all price ranges, contributing to gains in the months of supply. City wide most of the shift toward more balanced conditions is driven by homes in the higher price ranges. However, variation does exist depending on location, with the tightest conditions occurring in the City Centre district with just under two months of supply. Meanwhile, the North East has seen the row market hover from balanced to buyer’s market conditions, averaging five months of supply this year. This has resulted in some variation in price movements depending on location.

APARTMENT

Additional rental supply and new construction are having an impact on resale activity in the apartment sector. Improved rental supply and easing rents tend to weigh on condominium demand, especially during times of uncertainty as renters slow their shift to ownership at the same time investor demand eases. Sales activity has declined from last year’s record high at the same time that inventory levels are rising. This has caused the market to shift from one that favoured the seller to one that is more balanced. While supply has risen across the city, the supply demand balance does vary. The North East is currently experiencing buyer’s market conditions and higher price adjustments, while conditions are balanced to tight in other parts of the city, with little to no price adjustments from peak. This indicates that conditions can vary significantly depending on price range and location. Citywide conditions started shifting toward a more balanced state at the end of 2024, persisting throughout this year with not quite 4 months of supply in May. This has weighed on condo prices as of late, as they remain three percent shy of peak levels reported last year. However, it is important to note that recent pullbacks have not erased all the gains, as prices in May were 16 percent higher than levels reported in May 2023. While citywide prices are likely to remain relatively stable in the coming months, previous pullbacks are expected to leave annual prices just below last year’s levels.

Blog Source: CREB's Spring 2025 Update Report