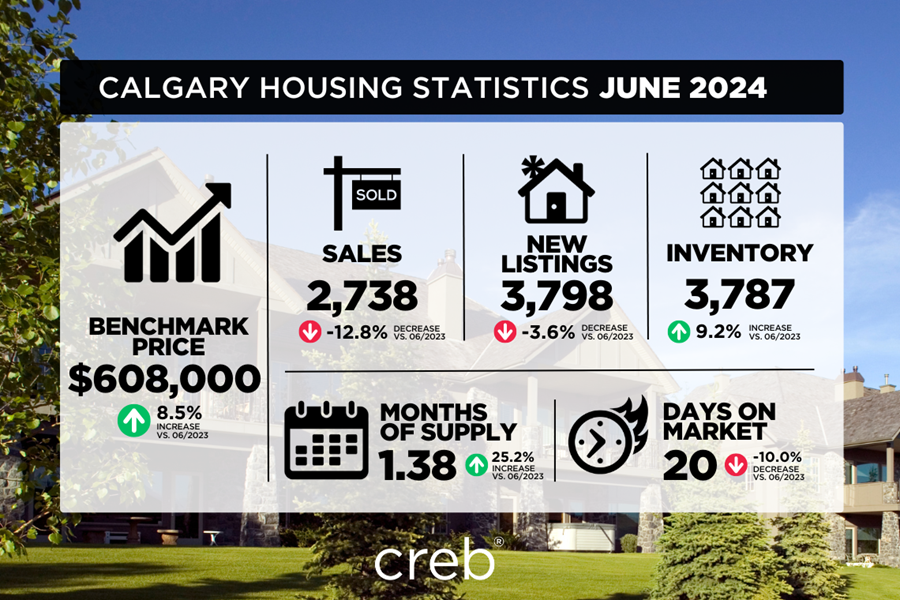

Sales in June reached 2,738, a 13 percent decline from last year’s record high. Although sales improved for homes priced above $700,000, it was not enough to offset the declines reported in the lower price ranges. Despite the easing in June sales, they remain over 17 percent higher than long-term trends.

“The pullback in sales reflects supply challenges in the lower price ranges, ultimately limiting sales activity,” said Ann-Marie Lurie, Chief Economist at CREB®. “Inventory in the lower price ranges of each property type continues to fall, providing limited choices for potential purchasers looking for more affordable products. It also continues to be a competitive market for some buyers with over 40 percent of the homes sold selling over list price.”

This month, new listings also eased relative to sales, causing the sales-to-new-listings ratio to remain elevated at 72 percent. Inventory levels did improve over last year’s low levels, primarily due to gains in the higher price ranges. However, with 3,789 units available, levels remain 40 percent lower than long-term trends.

The modest change in inventory levels helped increase the months of supply. However, at 1.4 months, conditions continue to favour sellers. Persistently tight conditions drove further price gains this month. In June, the unadjusted benchmark price rose to $608,000, a gain over last month and nearly nine percent higher than last year. Prices rose across all districts, with the most significant year-over-year gains occurring in the North East and East districts.

Housing Market Facts

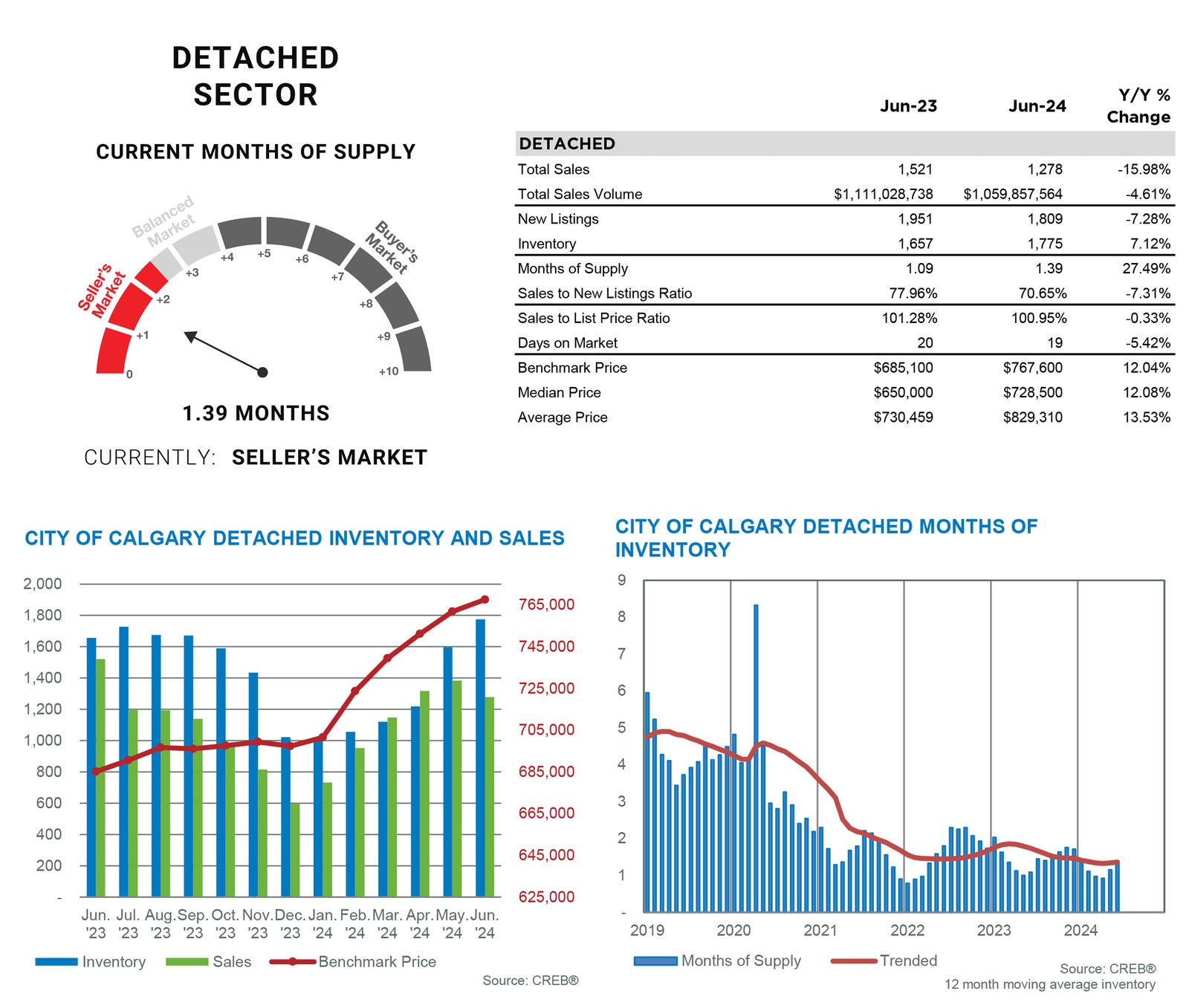

DETACHED

Gains in higher-priced detached home sales were not enough to offset the pullbacks for homes priced below $700,000, leading to a 16 percent year-over-year sales drop. Despite the recent pullback, detached home sales for the first half of the year remain in line with levels reported last year. Meanwhile, following several months of gains, new listings eased this month. By the end of June, there were 1,775 detached homes in inventory, an improvement over last year but 45 percent below long-term trends for the month.

While conditions remain tight in the detached market, we are starting to see better supply and demand balances in the upper end of the market. The months of supply have ranged from a low of one month in the most affordable East district to just over two months in the City Centre. Nonetheless, with less than one and a half months of supply, we continue to see upward pressure on home prices. In June, the unadjusted benchmark price reached $767,600, nearly one percent higher than last month and 12 percent higher than prices reported last June.

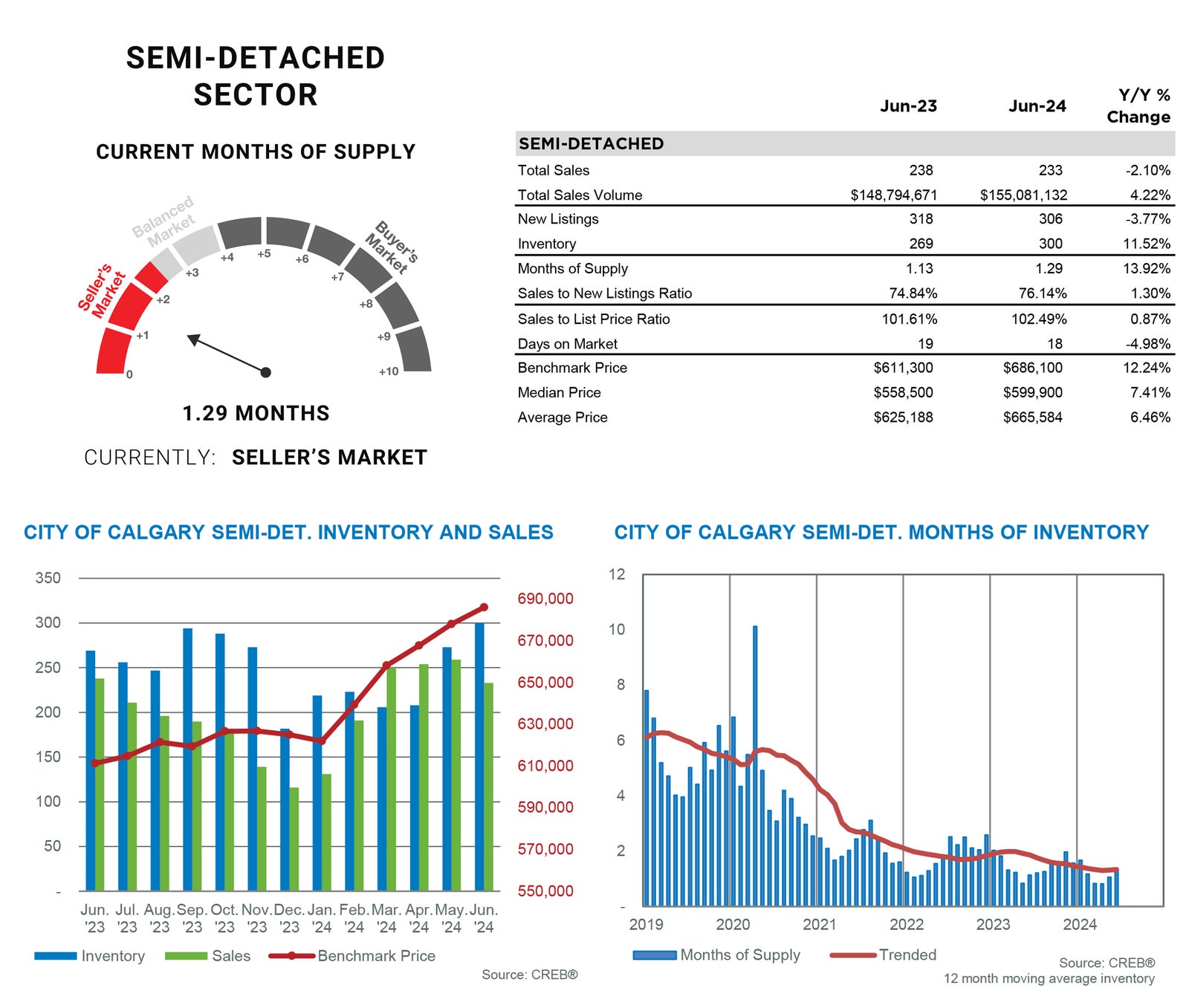

SEMI-DETACHED

Following a significant gain last month, new listings pulled back in June relative to sales, causing the sales-to-new-listings ratio to rise to 76 percent. While this did not prevent some gains in inventory levels, inventory levels remained nearly half of those traditionally seen in June.

With just over one month of supply, we continue to see upward pressure on home prices. In June, the unadjusted benchmark price reached $686,100, a one percent gain over last month and over 12 percent higher than levels reported last year. Prices rose across all districts in the city, with the steepest gains occurring in the most affordable areas of the North East and East districts.

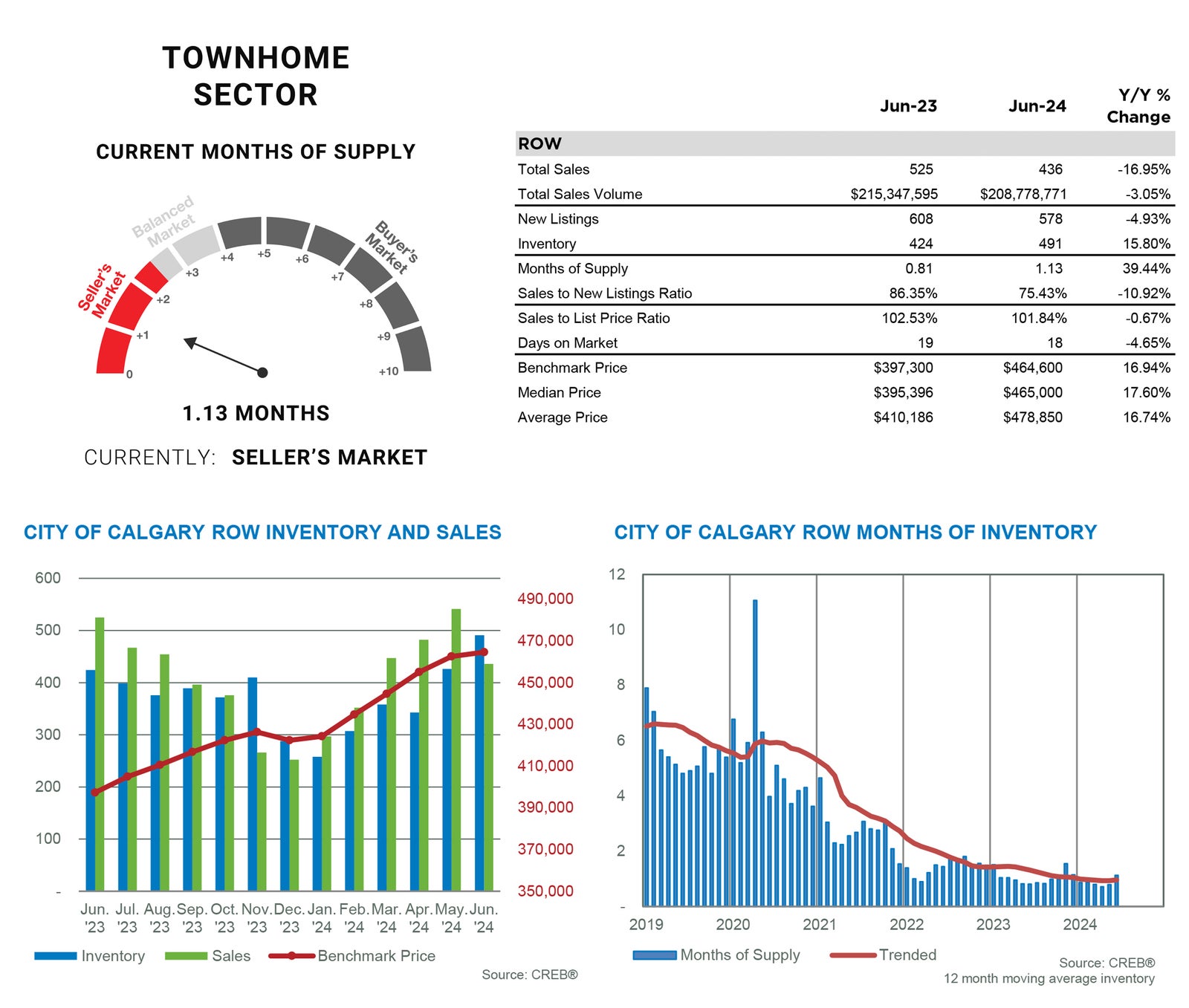

TOWNHOME/ROW

Like other property types, row home sales slowed in June relative to the high levels achieved over the past two years. A higher pullback in sales compared to new listings caused the sales-to-new-listings ratio to fall to 75 percent, the lowest June level reported since 2021.

However, conditions remain exceptionally tight, with one month of supply, especially for properties priced below $600,000. The unadjusted benchmark price trended up in June, reaching $464,600, nearly 17 percent higher than levels reported last year at this time. While price adjustments have varied depending on location, we continue to see the highest price growth occurring in the most affordable districts.

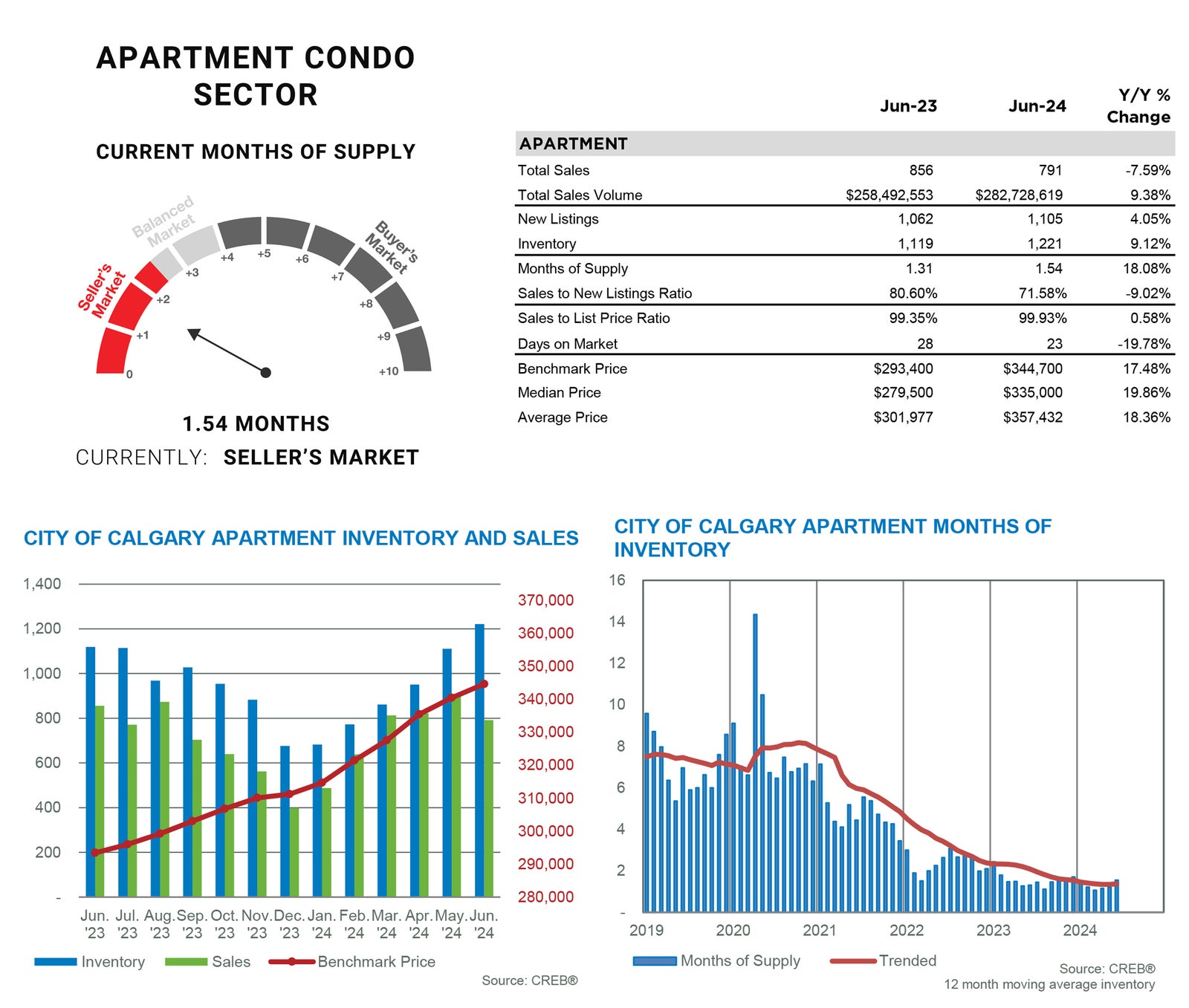

APARTMENT

There were 791 sales in June, a nearly eight percent decline over last year. The decline was primarily due to the significant pullback for units priced below $300,000. Limited supply choice for lower-priced products is preventing stronger sales activity. Despite the monthly pullback, year-to-date apartment sales are up by 13 percent and are at record-high levels.

New listings continue to rise relative to sales, causing the sales-to-new-listings ratio to fall and driving further inventory gains. However, much of the supply growth has occurred for higher-priced properties, resulting in tight conditions at the lower end of the market and more balanced conditions for higher-priced units. Overall prices continued to trend up this month, reaching $344,700, over 17 percent higher than last year.