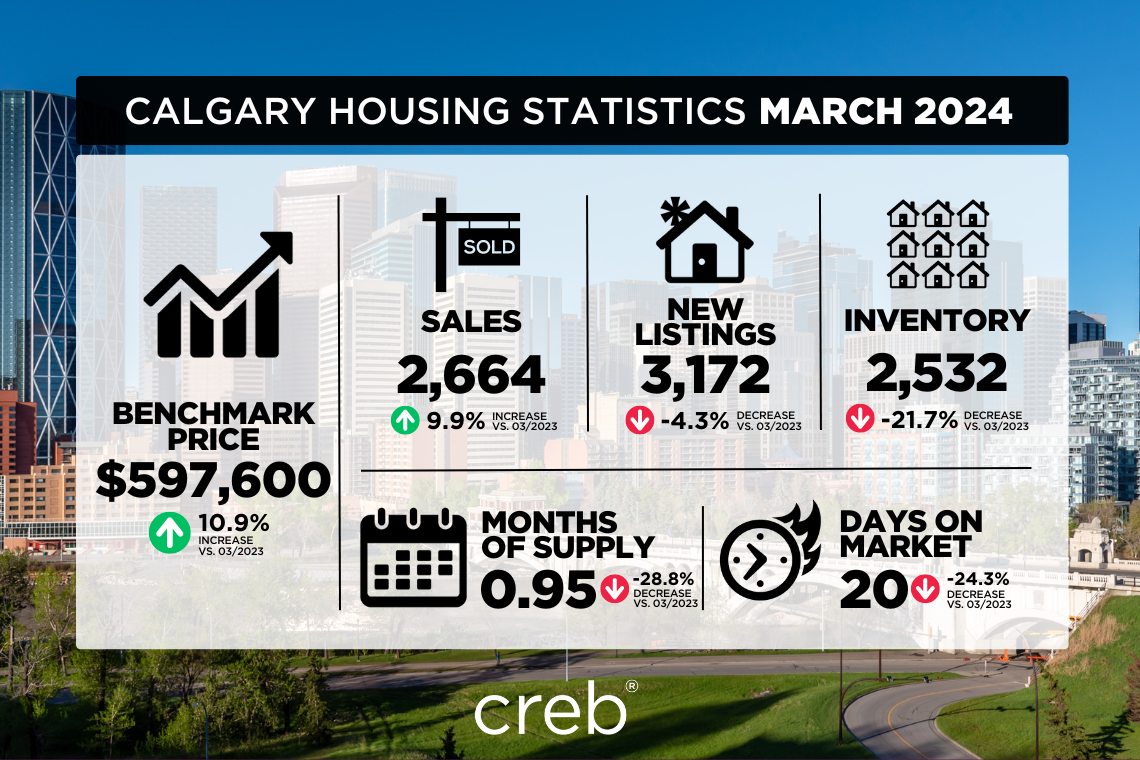

“We have not seen March conditions this tight since 2006, which is also the last time we reported high levels of interprovincial migration and a months-of-supply below one month," said Ann-Marie Lurie, Chief Economist at CREB®. “Moreover, we are entering the third consecutive year of a market favouring the seller as the two-year spike in migration has driven up demand and contributed to the drop in re-sale and rental supply. Given supply adjustments take time, it is not a surprise that we continue to see upward pressure on home prices.”

Inventory levels have declined across properties priced below $1,000,000, with the steepest declines occurring for homes priced below $500,000. In March, there were 2,532 units in inventory, 22 percent lower than last year and half the levels we traditionally see in March.

In March, the unadjusted total residential benchmark price rose to $597,600, a two percent gain over last month and nearly 11 percent higher than last year. Prices have increased across all property types, with the most significant year-over-year gains occurring for the relatively more affordable row and apartment-style homes.

Housing Market Facts

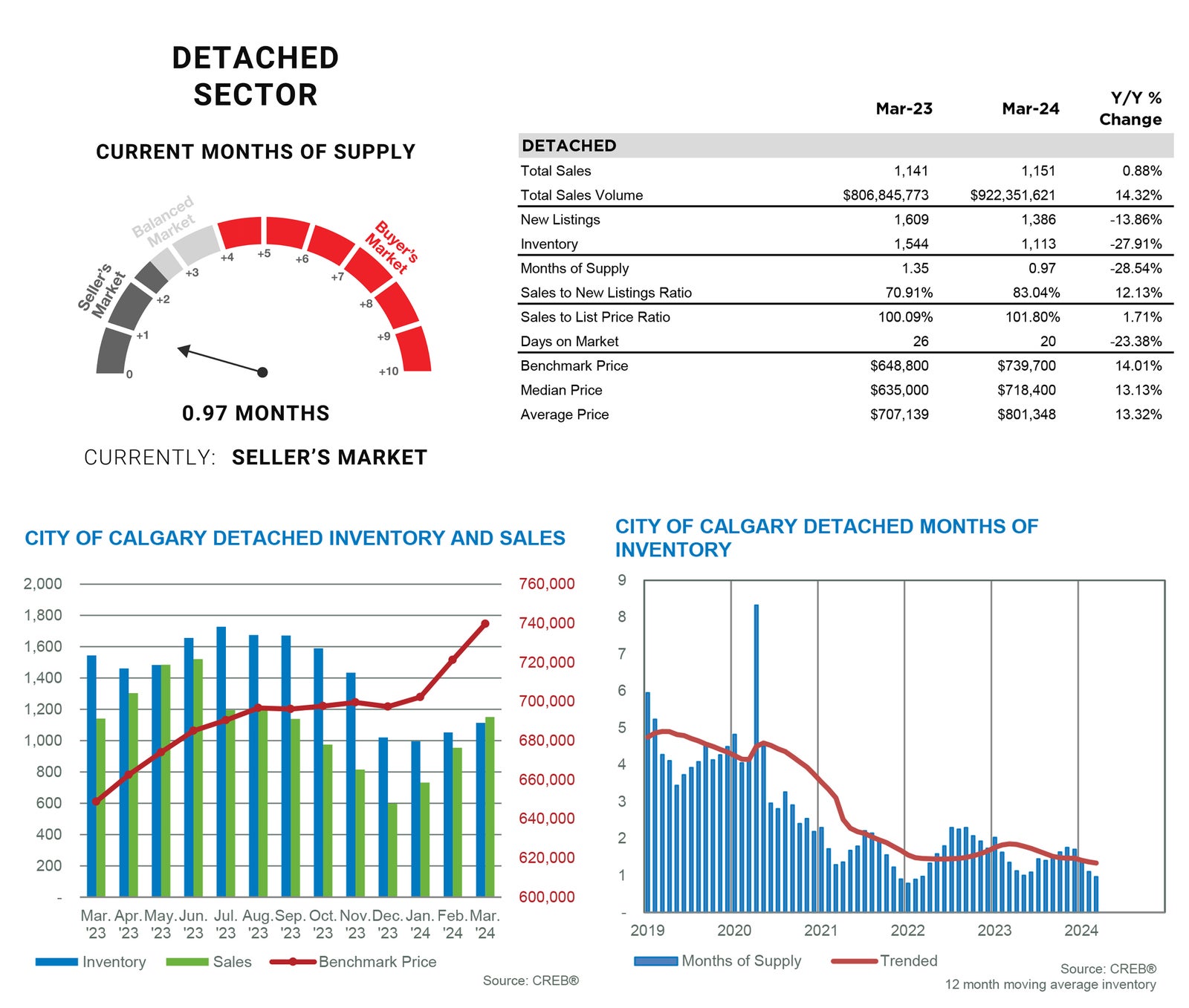

DETACHED SECTOR

Detached home sales rose in March but were likely limited by the level of new listings coming onto the market. New listings in March were 1,386 units, compared to the 1,151 sales, causing the sales-to-new listings ratio to rise to 83 percent. Inventories also remained relatively stable compared to last month but were 24 percent lower than last year’s levels and nearly 60 percent lower than long-term trends for March. Inventory levels dropped across all price ranges, but the most significant fall was in the lower price point. Overall, 71 percent of the available inventory in March was priced above $700,000.

Low inventories compared to sales caused the months of supply to drop below one month, driving further price gains. The unadjusted detached benchmark price rose to $739,700, a monthly gain of nearly three percent and a year-over-year gain of 14 percent. The largest year-over-year gains occurred in the most affordable North East and East districts.

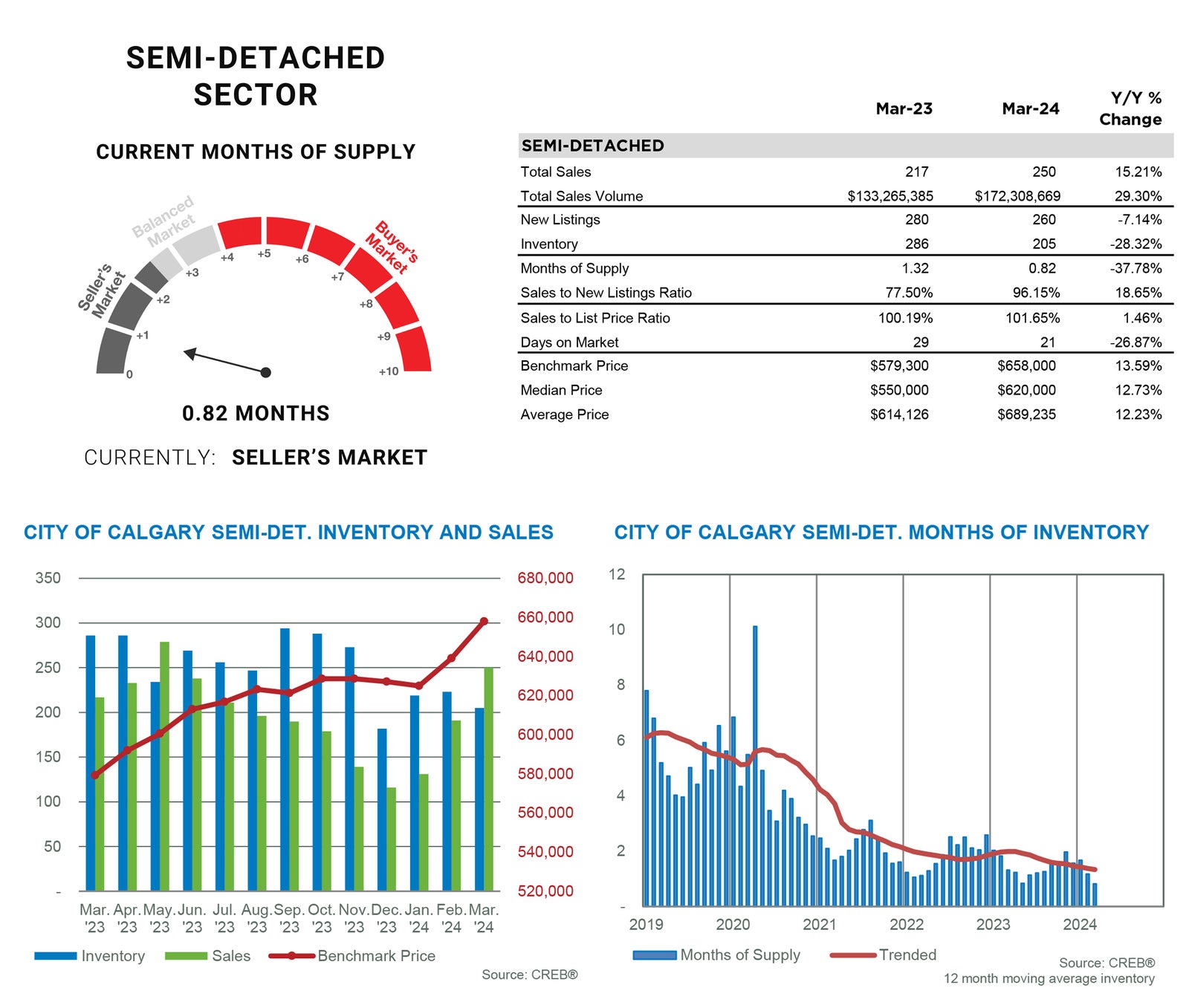

SEMI-DETACHED SECTOR

Supply availability continues to weigh on the semi-detached sector of the market. In March, 260 new listings were met with 250 sales, causing the sale-to-new listings ratio to rise to 96 percent. This prevented inventories from improving, and the months of supply dropped below one month. Inventory declines have been driven mainly by properties priced below $600,000.

Limited supply and growing demand drove further price gains in March. The unadjusted benchmark price reached $658,000, nearly three percent higher than last month and a 14 percent gain over last March. Prices rose across all districts in the city, with year-over-year gains ranging from a low of 11 percent in the highest-priced area of the City Centre to 25 percent in the lowest-priced market in the East district.

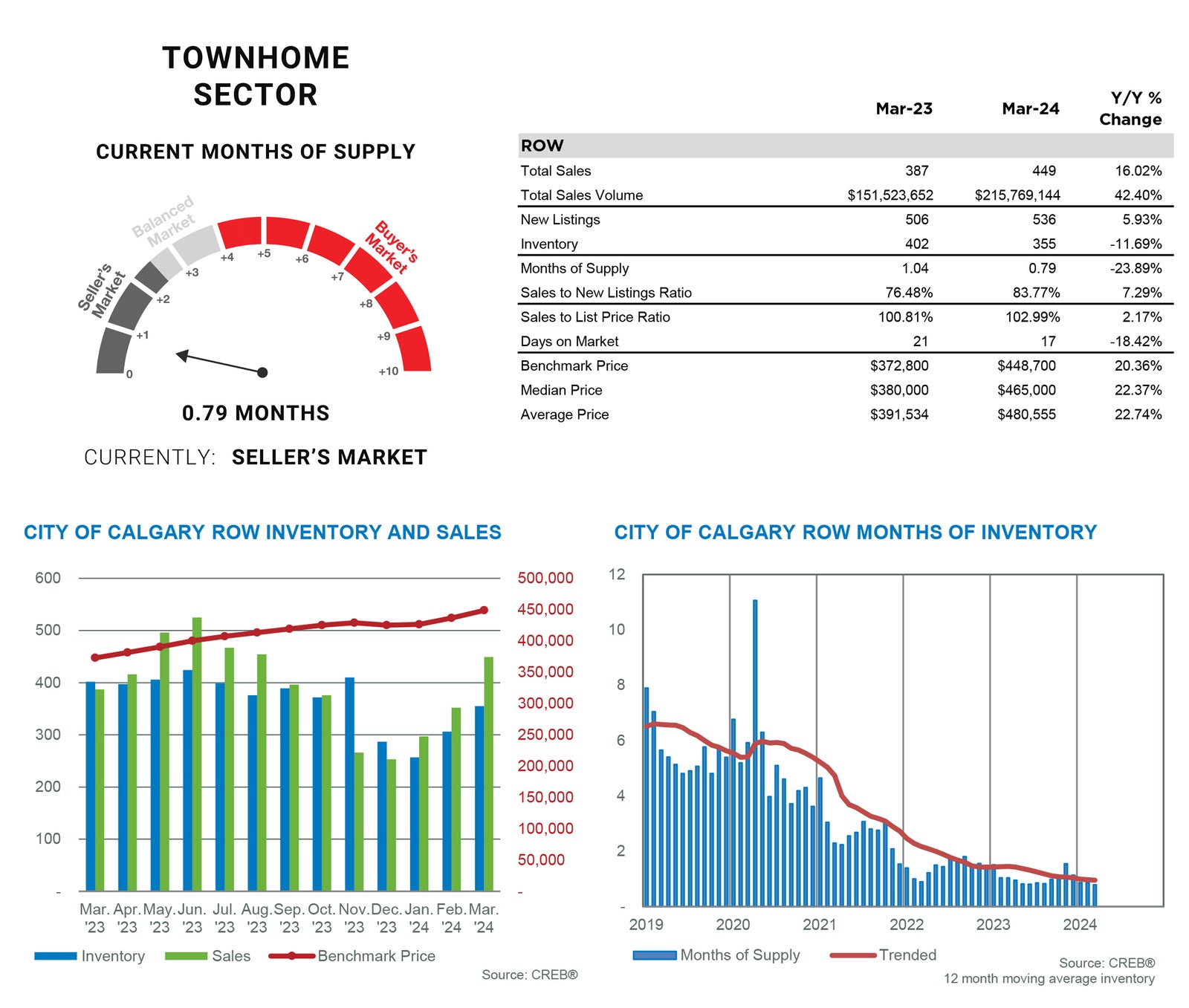

TOWNHOME/ROW SECTOR

Both sales and new listings rose in March. However, with 536 new listings and 449 sales, the sales-to-new listings ratio rose to 84 percent, preventing any significant monthly change in inventory levels. With 355 units available, inventory levels were 12 percent below last year’s and 53 percent below long-term trends for March. The decline in inventory levels was driven by properties priced below $400,000, as inventory levels rose 35 percent for units priced above $400,000.

The unadjusted benchmark price trended up in March, reaching $448,700, a monthly gain of nearly three percent and over 20 percent higher than levels reported at this time last year. The higher-priced City Centre reported the slowest growth in benchmark prices, with the highest growth reported in the city's most affordable districts.

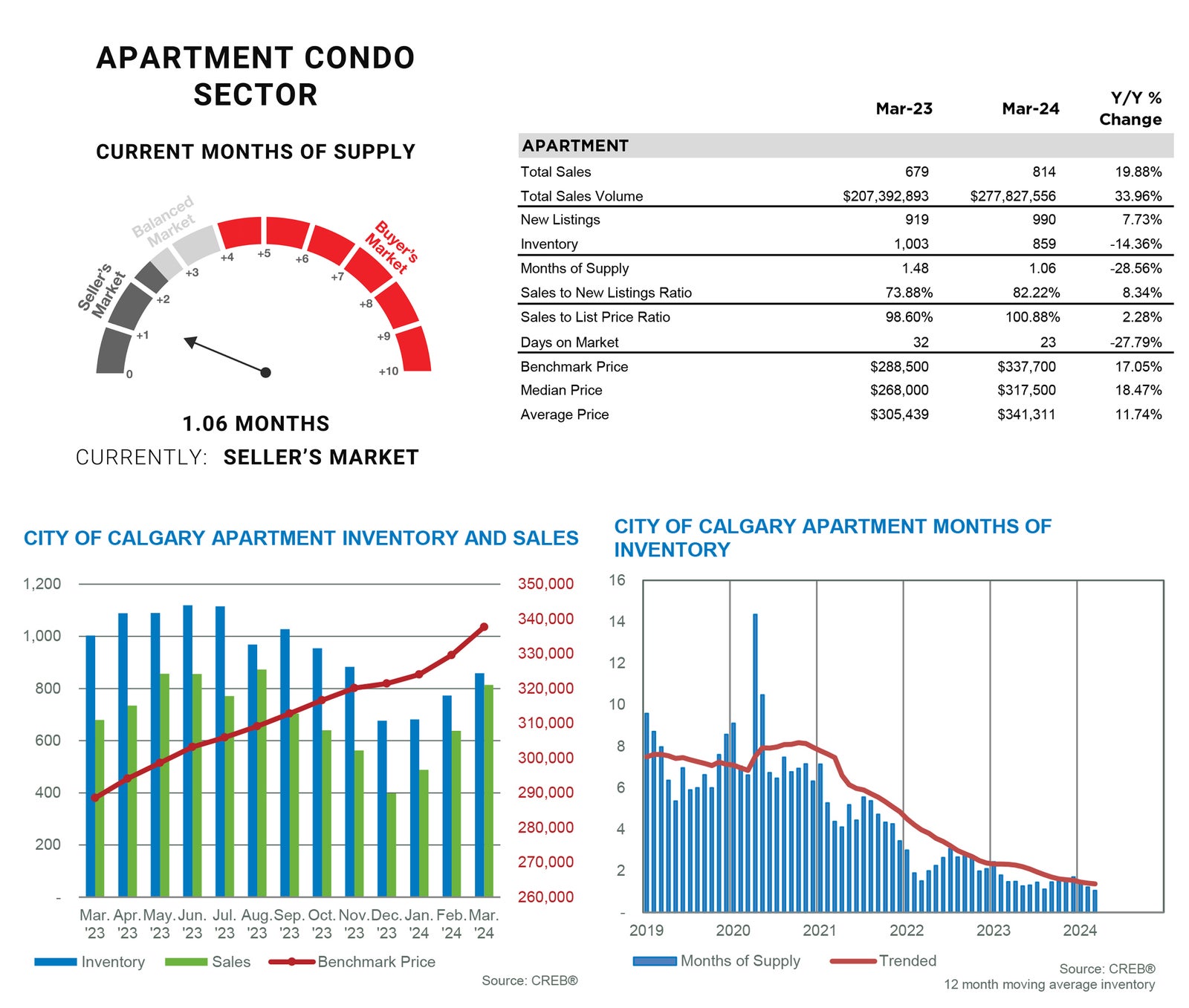

APARTMENT SECTOR

Sales in March reached 814 units, contributing to the first quarter’s record-high sales of 1,940 units, nearly 31 percent higher than last year. New listings also improved throughout the first three months of the year, but with a March sales-to-new-listings ratio of 82 percent and a months-of-supply of one month, conditions favoured apartment condominium sellers.

Demand for lower-priced homes has supported the growth of apartment-style properties, but the tight conditions have also contributed to further price gains. In March, the benchmark prices reached $337,700, over two percent higher than last month and 17 percent higher than levels reported last March.