The Calgary Real Estate Board (CREB) recently put out their annual market and economic review and forecast. This annual report examines the housing sector, local Calgary economy, and other variables which impact real estate such as lending rates and migration patterns.

Here, a look at what CREB has to say about the Calgary real estate market. If you are looking for insights into the Calgary economic forecast, visit our sister post: CREB 2023 ECONOMIC REVIEW & 2024 FORECAST

HOUSING FORECAST SUMMARY

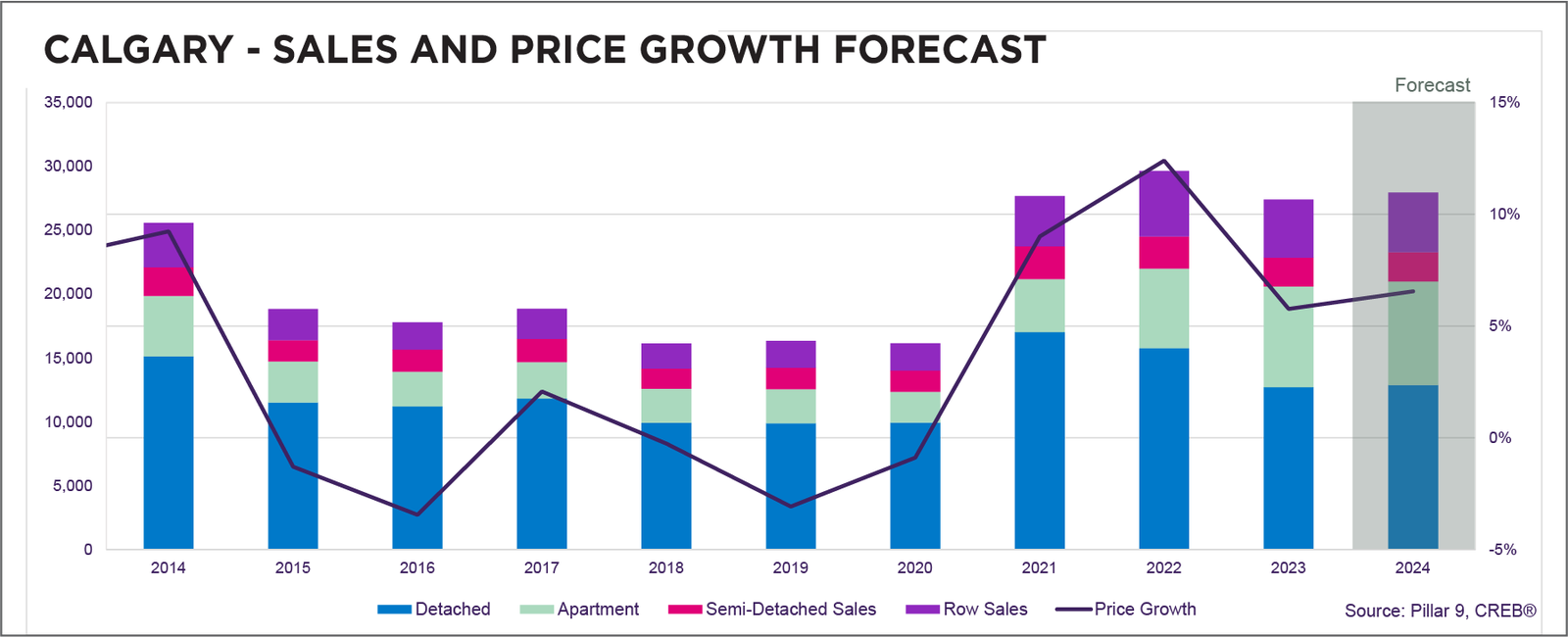

Rising lending rates have had a notable impact on the housing sector, prompting potential buyers to search for more affordable housing options. Simultaneously, some potential sellers have refrained from listing their homes to avoid the consequences of higher rates. The decrease in new listings at lower price points has likely hindered overall sales activity, particularly as lower-priced properties contributed to declines in sales during 2023. Despite a moderation from record-high levels, strong migration growth and a robust labour market have kept sales well above long-term trends.

While international migration has influenced rental markets, resulting in increased rental gains and heightened demand from investors, interprovincial migration from higher-priced markets in British Columbia and Ontario has helped support sales growth in the higher price ranges of our market, even in the face of higher lending rates.

Moving into 2024, we anticipate that potential buyers who were previously on the sidelines due to limited supply choices may reenter the market as lending rates ease and listings improve.

At the same time, with more mortgages set to renew, we could see some gains in resale listings as existing homeowners who were previously hesitant to change their housing situation may be motivated to capitalize on rising prices and favourable seller market conditions. The combination of improved listings and heightened activity in the new home sector is anticipated to foster some growth in overall supply. However, given the persistent strong demand driven by recent migration and a healthy job market, it will take time for supply levels to rise sufficiently to restore balance to the market.

Although conditions are not expected to be as tight as in 2023, a seller’s market is projected to persist throughout the spring market, resulting in further price growth. However, the rate of growth for each property type is anticipated to slow compared to 2023 levels. Supply growth is expected to be mostly driven by the upper price ranges for each property type, which will likely decelerate the pace of price growth for higher-priced properties. Meanwhile, conditions are expected to remain tight for lower-priced properties, contributing to continued price gains.

2023 HOUSING MARKET SUMMARY IN CALGARY

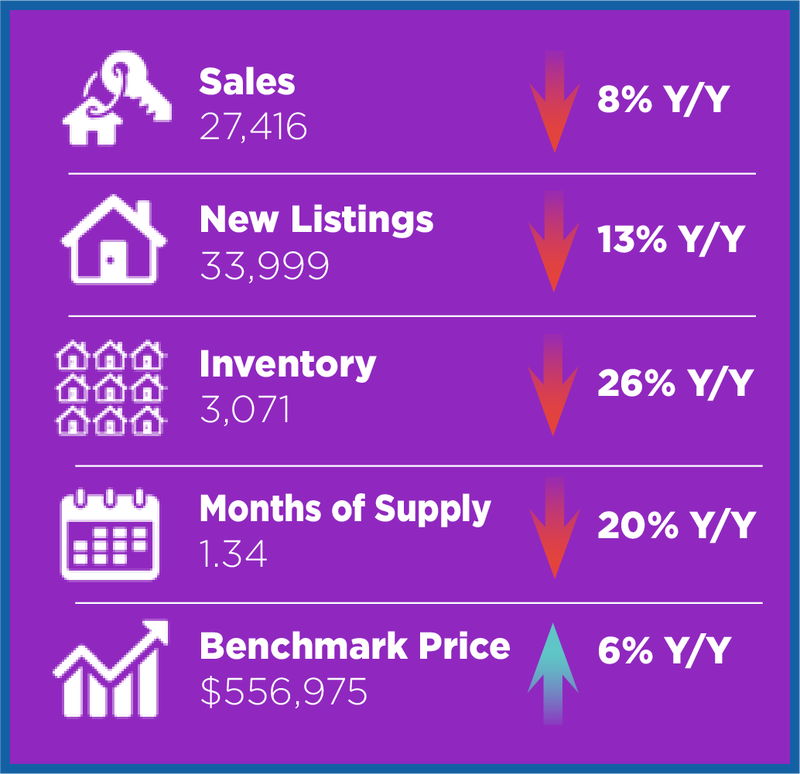

2023 HOUSING MARKET SUMMARY IN CALGARYThroughout 2023, challenges related to the supply of housing persisted. New listings declined throughout the lower price ranges, contributing to the pullback in sales. Higher lending rates drove more demand toward affordable products while also preventing some homeowners from making changes to their existing housing situation.

This resulted in further inventory declines, persistent seller market conditions, and higher-than-expected price growth. The only segment of the market to see improvements in new listings was in the upper end of the market, which likely contributed to the gain in sales for homes priced above $700,000.

This resulted in further inventory declines, persistent seller market conditions, and higher-than-expected price growth. The only segment of the market to see improvements in new listings was in the upper end of the market, which likely contributed to the gain in sales for homes priced above $700,000.

Housing Market

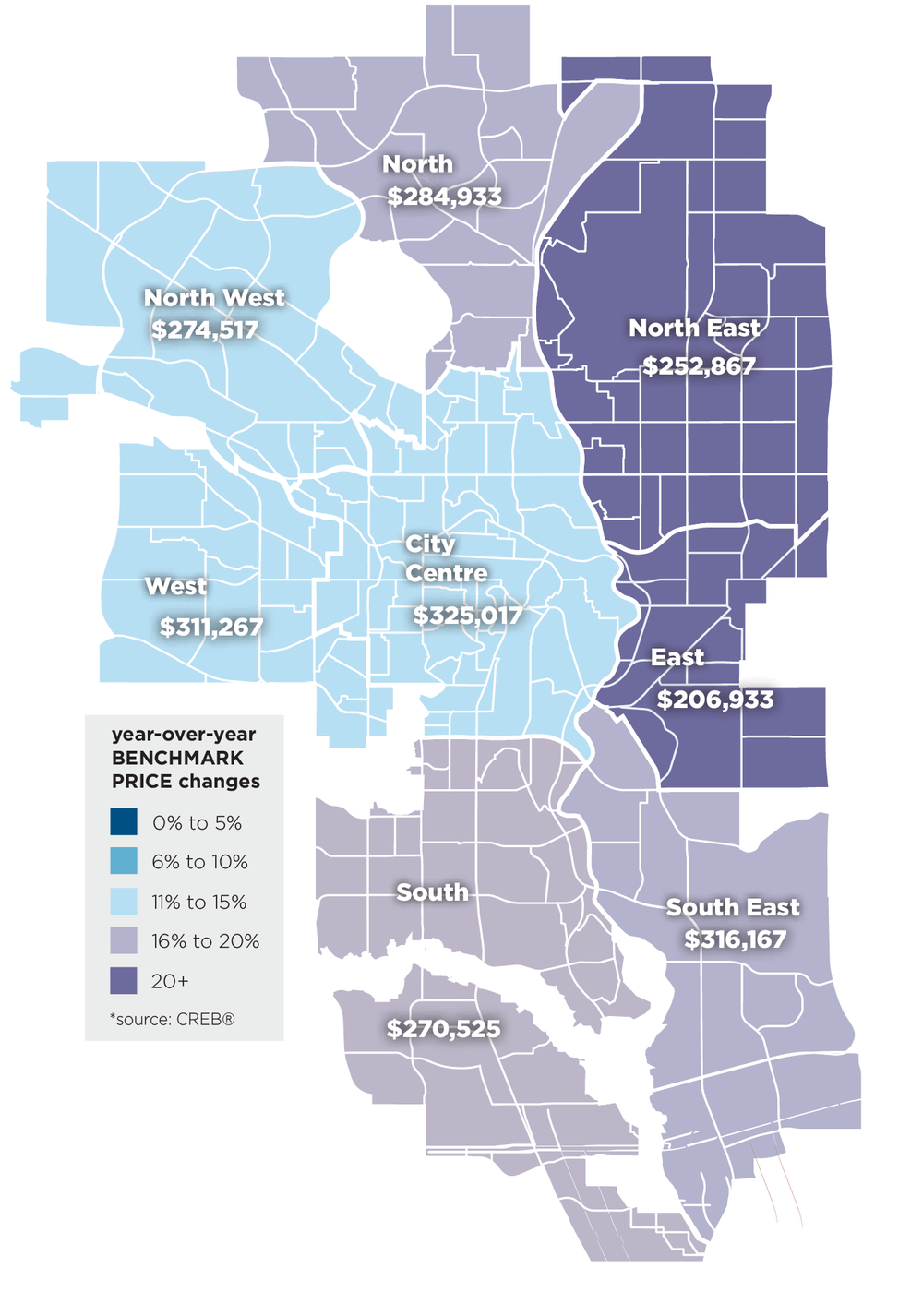

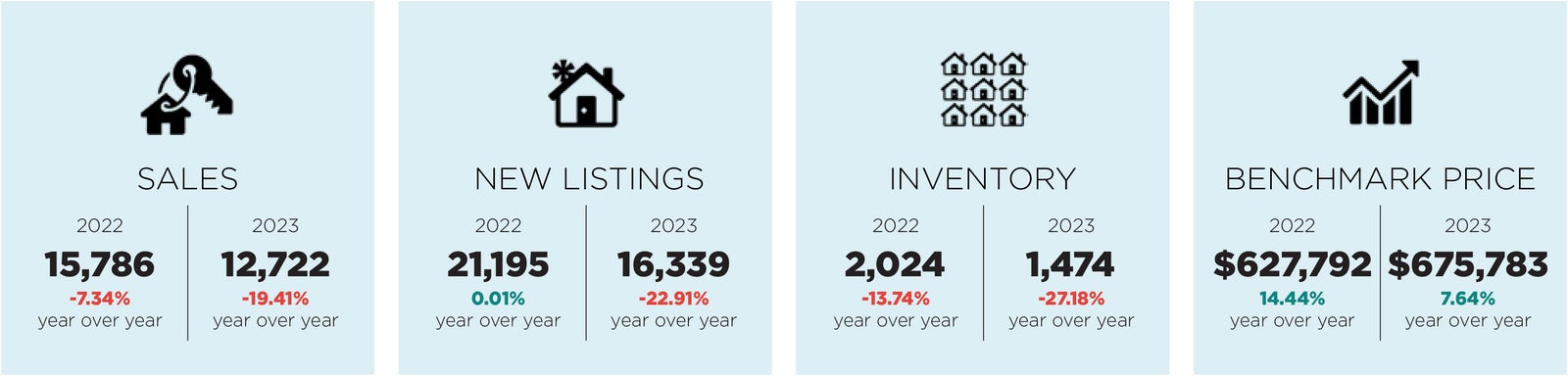

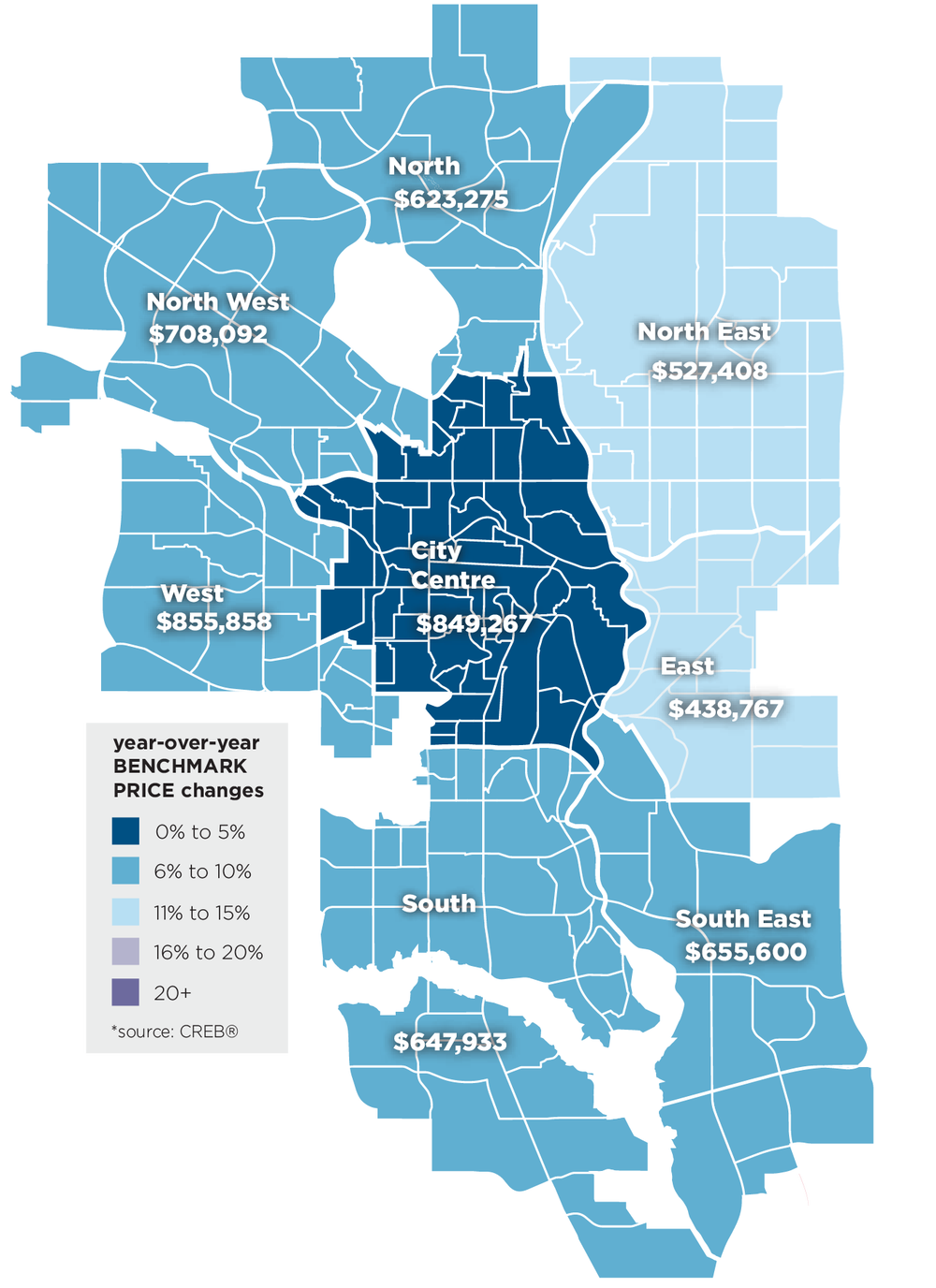

DETACHED

Despite gains in sales for homes priced above $700,000, the overall detached market experienced a 19 percent slowdown in 2023 sales. This decline was primarily driven by pullbacks in the lower price ranges, where limited inventory constrained stronger sales activity. On an annual basis, inventory levels averaged 1,474 units – the lowest ever reported and nearly 48 percent below long-term trends. The substantial drop in inventory outweighed the sales pullback, maintaining the market firmly in the seller’s territory throughout the year. The consistently tight conditions led to price increases across all districts, with the most significant gains occurring in the most affordable areas of the North East and East districts. Calgary’s annual detached benchmark price surged by nearly eight percent to $675,783, establishing a new record high.

Heading into 2024, an anticipated improvement in supply is expected to contribute to a modest upturn in sales activity. However, due to the low starting point, achieving sufficient supply growth will require time to restore balanced conditions. The majority of the supply gains are forecasted to occur in the upper price ranges, slowing the pace of price growth for higher-priced homes. Meanwhile, persistently tight conditions in the lower price ranges are likely to continue driving further price growth. Overall, prices are projected to rise by four percent, pushing above $700,000.

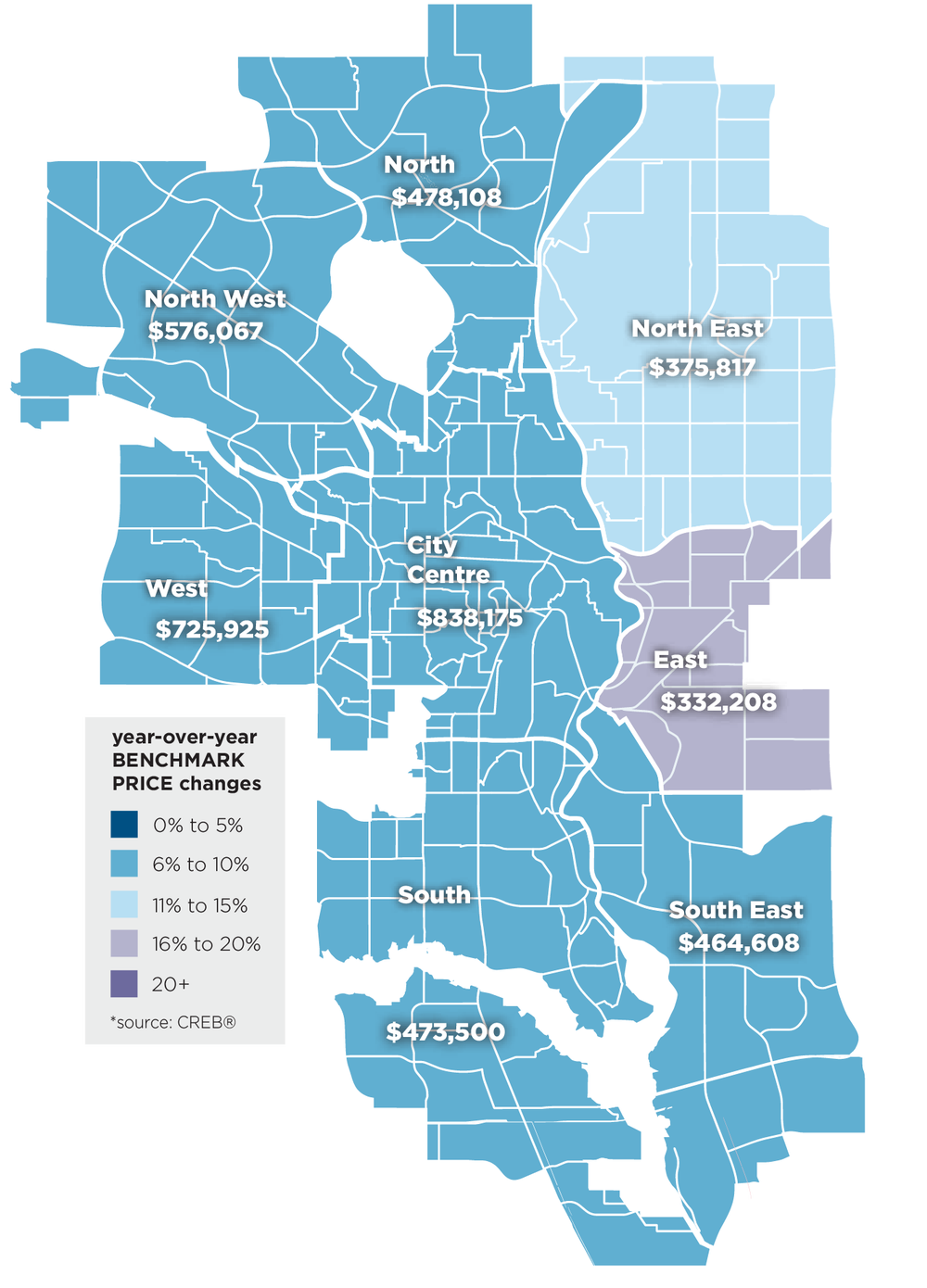

SEMI-DETACHED

A rise in demand for affordable products drove many consumers to seek out semi-detached homes. However, limited supply for properties priced below $500,000 prevented stronger sales activity in 2023, ultimately contributing to the annual 10 percent decline in sales. While sales did improve for higher-priced properties, it was not enough to offset the declines occurring in the lower price ranges. The pullback in supply compared to sales kept market conditions exceptionally tight throughout the year, averaging just over one month of supply and a sales-to-new-listings ratio of 82 percent. The tight market conditions contributed to the benchmark price’s seven percent annual gain. Prices rose across every district in the city, with the largest gains occurring in the most affordable districts of the East and North East.

New home starts have risen for semi-detached homes in 2023, which should help support some supply growth in 2024. However, it will take time for supply levels to return to levels that are more consistent with long-term trends, as demand is expected to remain relatively strong. As sales and new listings are expected to improve, we do not anticipate the market returning to more balanced conditions until later in 2024, driving further price growth.

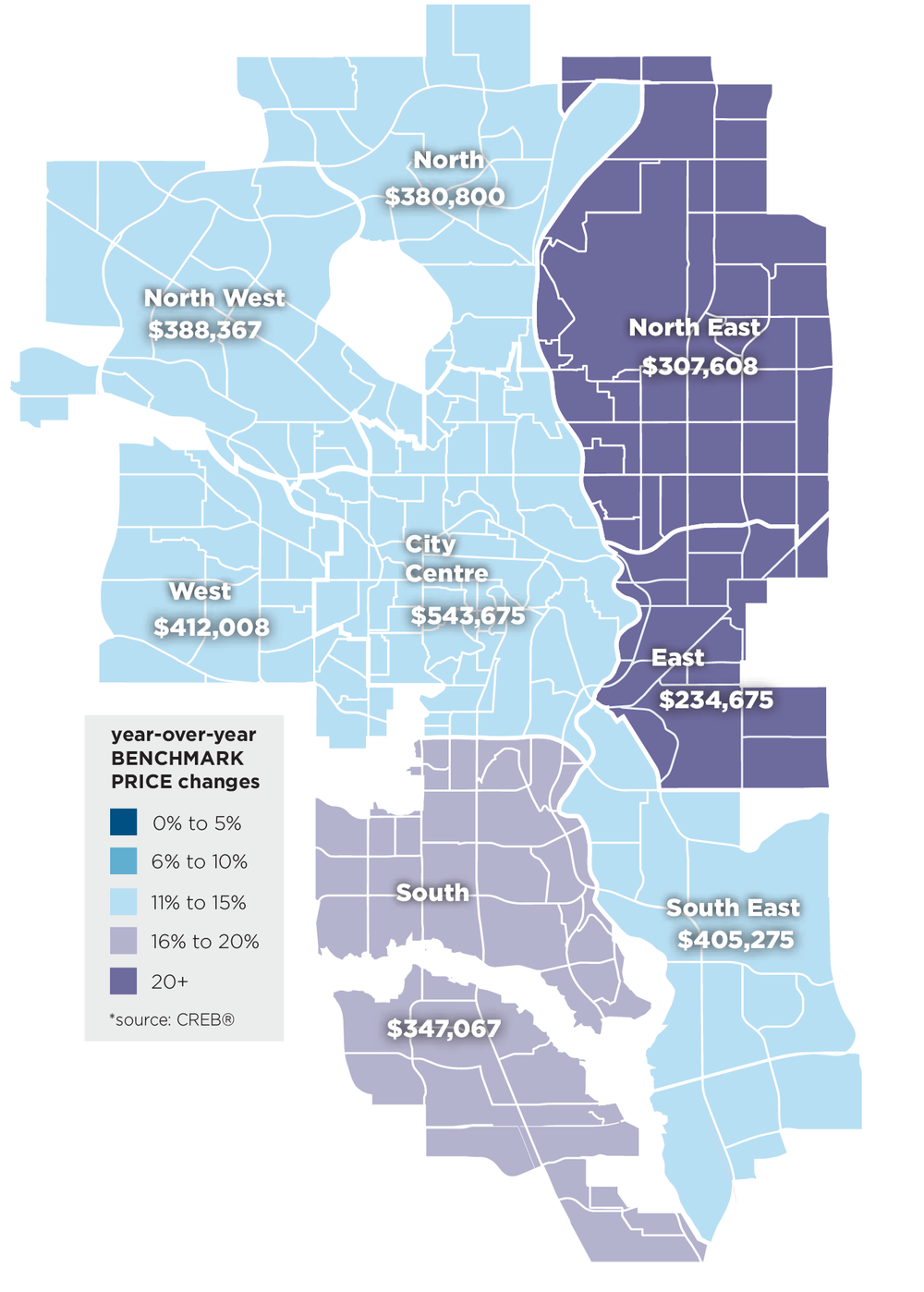

ROW/TOWNHOME

A pullback in new listings and relatively strong demand kept conditions exceptionally tight for row properties in 2023. The relative affordability attracted demand from purchasers, but the limited supply choice prevented stronger sales. In 2023, the average months of supply for row housing was one month, while the sales-to-new-listings ratio was 88 percent, reflecting conditions that were much tighter than last year. The exceptionally tight conditions resulted in the second consecutive year in a row of price growth of around 14 percent.

A surge in new home starts in 2023 should help support supply growth for this property type in 2024. However, the relative affordability will continue to support strong demand, prolonging the time it takes for this market to return to more balanced conditions and supporting further price growth in 2024, albeit at a slower pace.

APARTMENT

Sales for apartment condominiums surged in 2023 as a rise in demand for affordable ownership options and supply choices drove consumers to this market segment. Sales activity rose by nearly 27 percent, while new listings increased by nearly 18 percent.

The growth in new listings did help support the stronger sales, but conditions also tightened in this market, with the months of supply decreasing over the previous year and averaging one and a half months in 2023. The apartment condominium sector struggled with excess supply before the pandemic, but the surge in demand has shifted those conditions, supporting price growth. Prices in 2023 finally recovered and rose above the highs reported in 2014, with an annual price gain of over 13 percent.