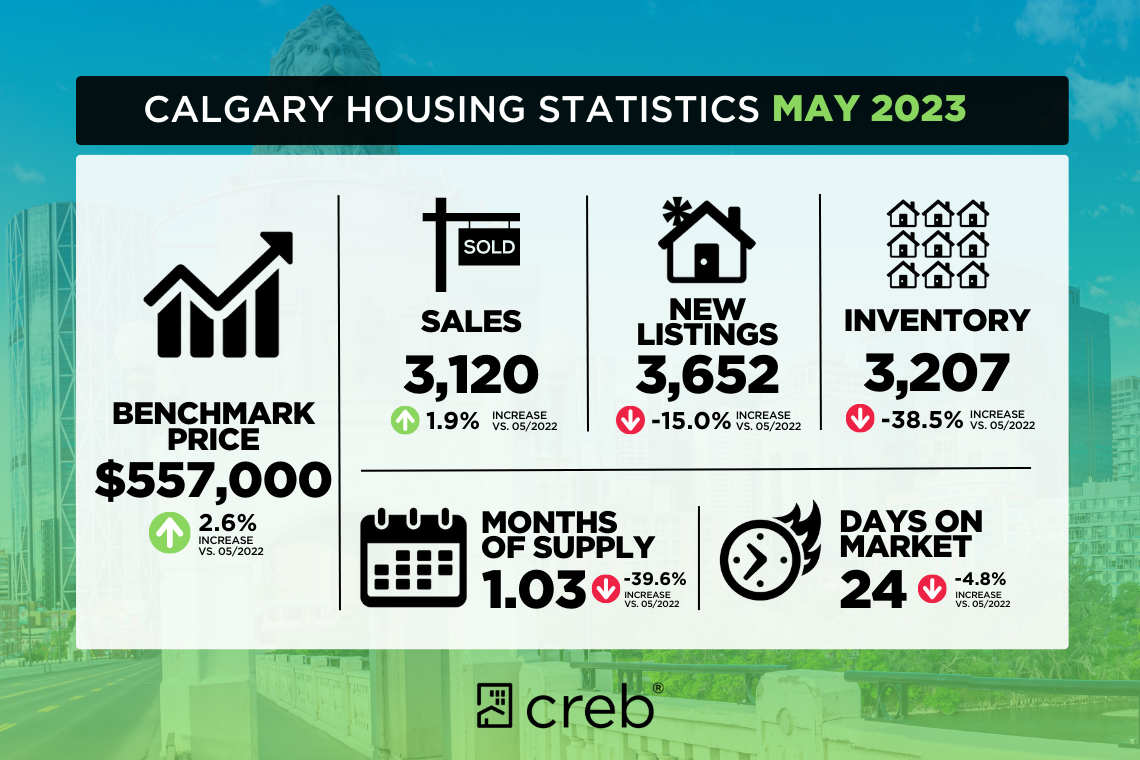

At the same time, we continue to see fewer new listings on the market than last year, causing inventory levels to fall. With a sales-to-new-listings ratio of 85 percent and months of supply of one month, conditions continue to favour the seller placing further upward pressure on home prices.

“Calgary’s housing market continues to exceed expectations with the recent gain in sales activity this month,” said CREB® Chief Economist Ann-Marie Lurie. “The higher interest rate environment and recent rental rate gains have driven more consumers to seek apartment condominium units. In addition, the recent rise in new apartment listings has provided enough options to support the sales gain. Calgary continues to benefit from the relatively healthy job market and recent population growth keeping housing demand strong across all property types.”

Persistently tight market conditions drove further price growth this month. In May, the unadjusted benchmark price reached $557,000, over one percent higher than last month and nearly three percent higher than last year’s monthly peak price of $543,000.

Housing Market Facts

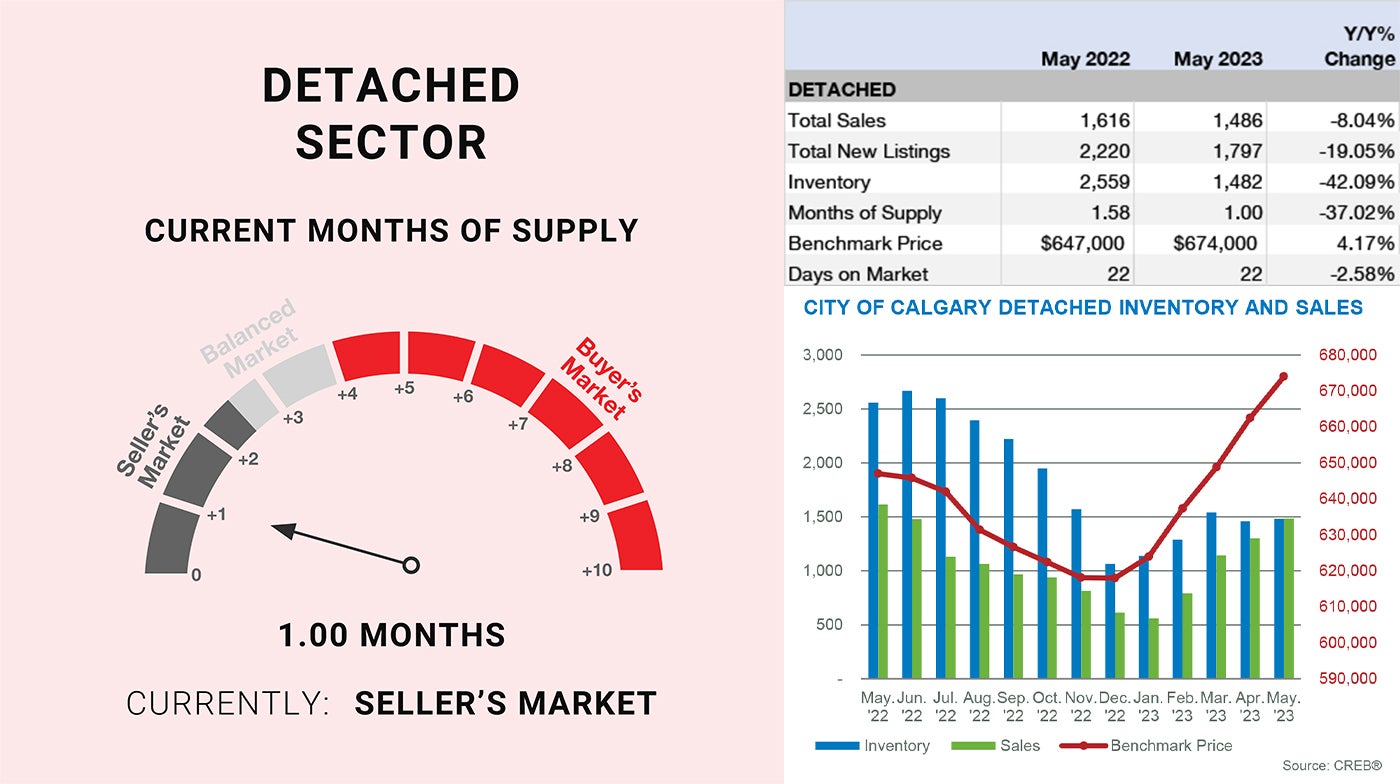

Detached

Rising sales for homes priced above $600,000 was not enough to offset declines in the lower price ranges as May sales reached 1,486, a year-over-year decline of eight percent. New listings continue to fall for homes priced below $700,000, providing limited choice for consumers seeking out lower-priced detached homes. While new listings did improve for higher-priced properties, the relatively strong demand kept conditions tight across all price ranges, driving further price gains.

In May, the detached benchmark price reached $674,000, nearly two percent higher than last month and over four percent higher than last year’s peak price of $647,000. While each district reported a new record high price this month, the year-over-year gains ranged from a high of 12 percent in the East District to a low of two percent in the City Centre.

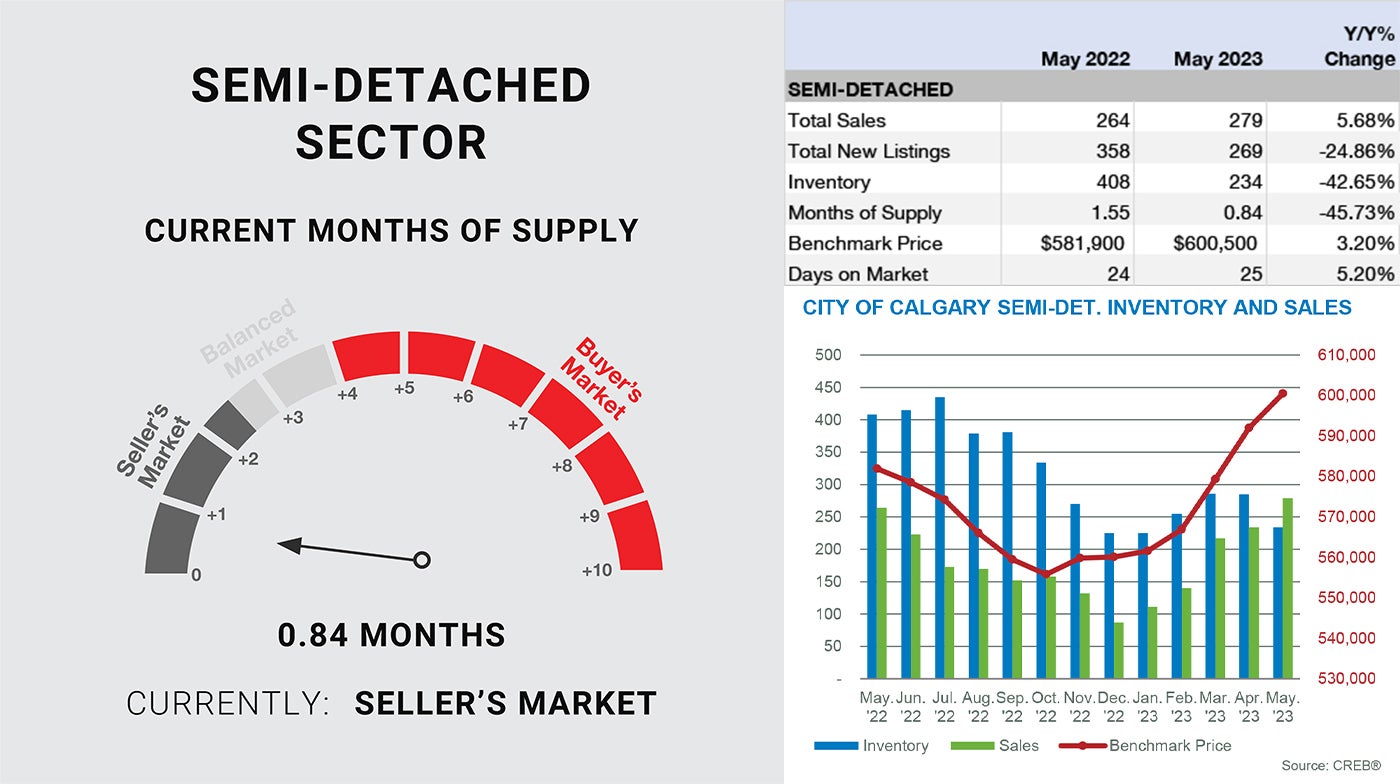

Semi-Detached

Sales also rose to near-record highs for the month for semi-detached homes. However, with 279 sales and 269 new listings this month, inventories fell, and the months of supply dropped below one month.

The exceptionally tight conditions caused further price gains, which for the first time, pushed above $600,000. This is the seventh consecutive month where prices have trended up, and as of May, levels are over three percent higher than last year’s monthly peak. Like the detached sector, each district reported new record high prices in May. However, the strongest year-over-year gains occurred in the most affordable East district at nearly 12 percent.

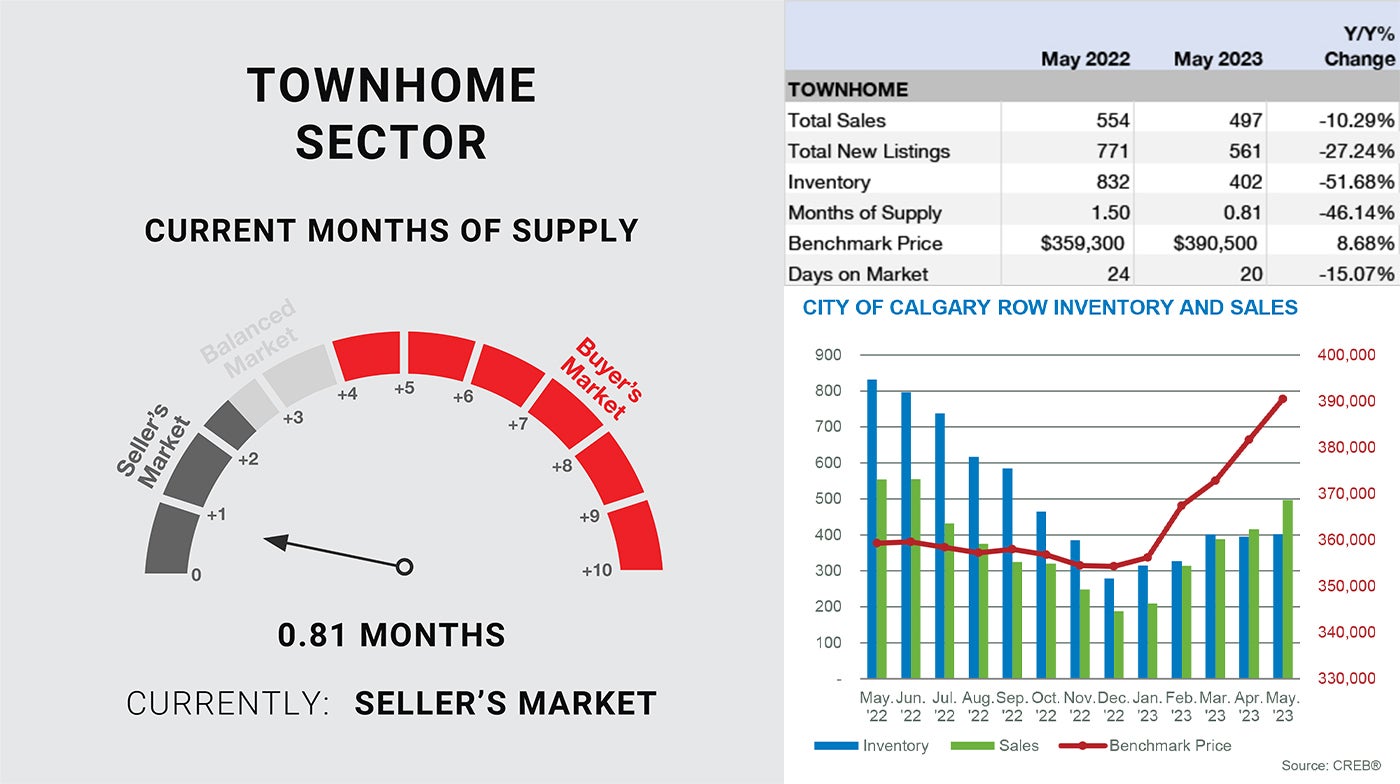

Row/Townhome

New listings in May improved over levels seen earlier in the year, but thanks to monthly gains in sales, the sales-to-new listings ratio remained exceptionally high at 89 percent, preventing any significant shift in the low inventory situation. While sales activity is still lower than last year’s levels, this is likely related to the lack of supply in this segment of the market. Inventory levels are down 50 percent compared to last year.

With less than one month of supply, it is not a surprise that prices continue to rise. In May, the benchmark price reached $390,500, a two percent gain over last month and nearly nine percent higher than last year's peak price of $359,600. Row prices rose across all districts, with year-over-year gains exceeding 15 percent in the city's North East, South and East districts. The slowest price gains occurred in The City Centre, North West and South East at rates of over seven percent.

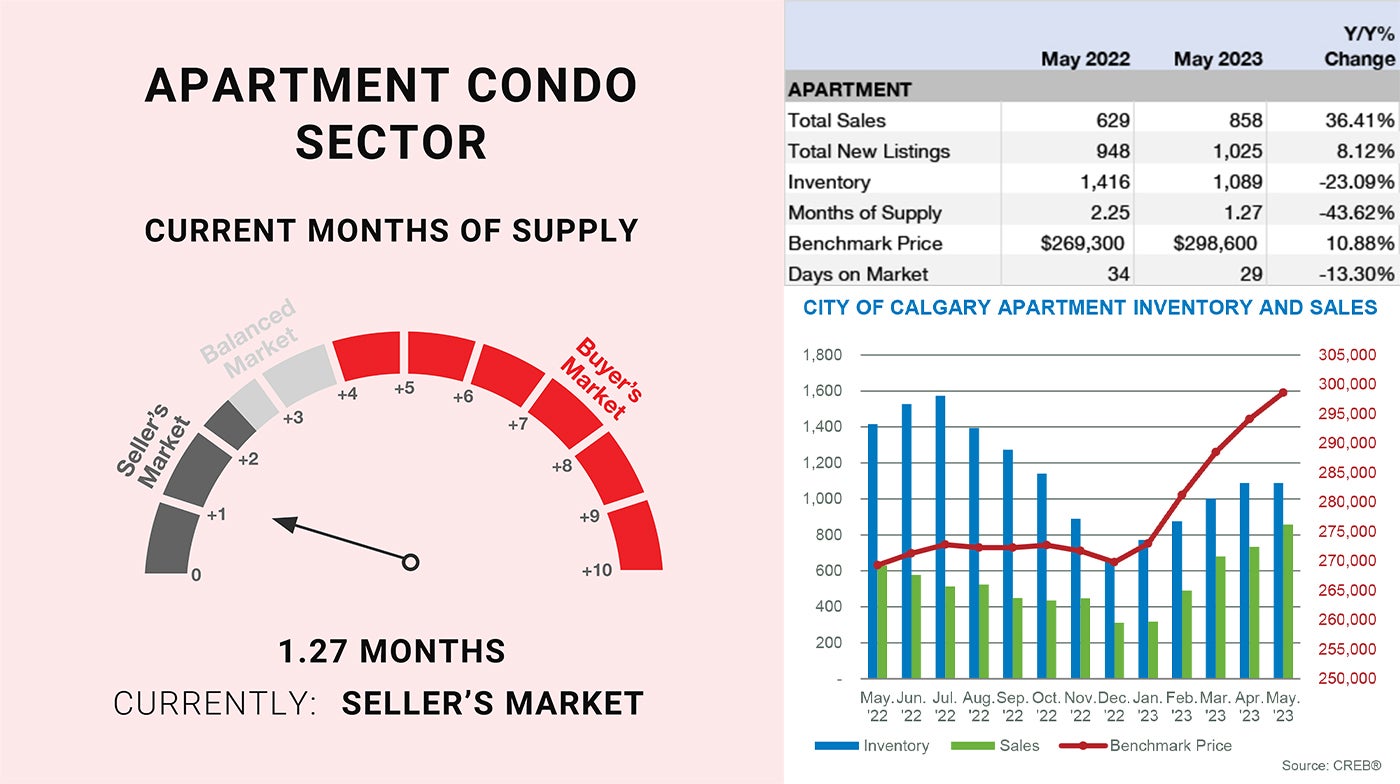

Apartment Condominium

Sales in May reached 858 units, a year-over-year gain of 36 percent and high enough to cause year-to-date sales to rise by four percent for a new record high. Stronger sales were possible thanks to the recent gains in new listings. There were 1,025 new listings in May, a year-over-year gain of eight percent. Despite the gain in new listings, the sales-to-new listings ratio remained high at 84 percent, preventing any significant shift in inventory levels. As a result, inventory levels remained 23 percent lower than what was available in the market in May 2022. The rising sales and low inventories kept the months of supply low at just over one month.

Persistently tight conditions drove further price gains in May. The unadjusted benchmark price reached $298,600, a monthly gain of over one percent and a year-over-year gain of nearly 11 percent. The recent growth has finally caused unadjusted apartment condominium prices to return to 2014 levels. Unlike other areas, not all districts reported a new record high price. The only areas to report a full recovery were the North, North West, West and South East districts. Overall year-over-year price growth ranged from a high of 16 percent in the North District to a low of 10 percent growth in the City Centre.