“While no further rate gains have occurred so far this year, the higher lending rates and limited supply options are contributing to some of the pullbacks in sales,” said CREB® Chief Economist Ann-Marie Lurie. “Nevertheless, despite the decline, sales activity has remained well above pre-pandemic levels thanks to recent gains in migration coupled with a stronger employment market.”

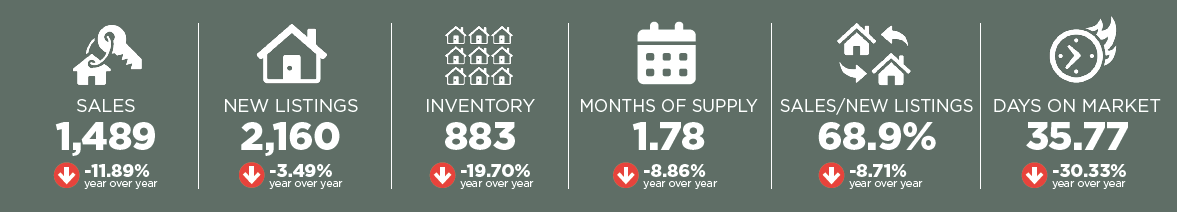

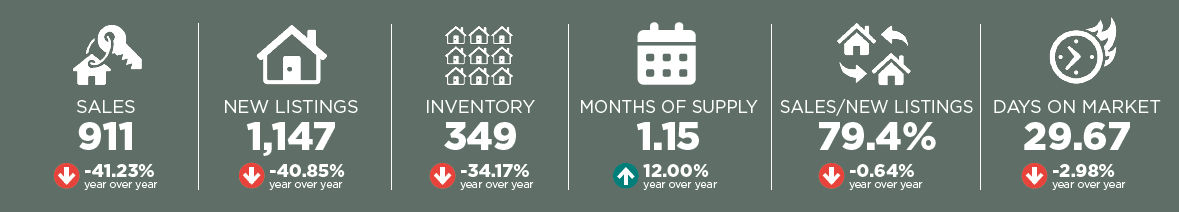

The most notable challenge in the market has been related to supply levels. New listings were expected to ease as higher lending rates would make it more difficult for the move-up buyer. However, the pace of decline in new listings has exceeded expectations. New listings in the first quarter declined by 40 per cent, preventing any significant shift in the supply levels given the relatively strong sales.

Inventory levels in the city averaged 2,814 units in the first quarter, 21 per cent lower than last year’s levels and over 42 per cent below long-term trends for the first quarter. With a sales-to-new-listings ratio of 71 per cent and a months of supply of under two months in the first quarter, conditions continue to favour the seller.

Exceptionally tight market conditions early last year drove significant price gains throughout the 2022 spring market, peaking at $544,733 in the second quarter. While supply-demand balances remained tight throughout 2022, prices did trend down over the third and fourth quarters, somewhat adjusting for the rapid rise earlier in the year.

Further tightening in the supply-demand balance in the first quarter was enough to stop the downward price trend as the quarterly benchmark price rose by nearly two per cent over the fourth quarter to $531,200 but remained below the Q2 high.

“Some of the fluctuations in price were expected this year, given what happened last year,” said Lurie. “However, price growth to date has been stronger than expected. Given the limited supply currently on the market, we could expect to see some stronger price growth through spring, potentially supporting a modest annual gain in 2023.”

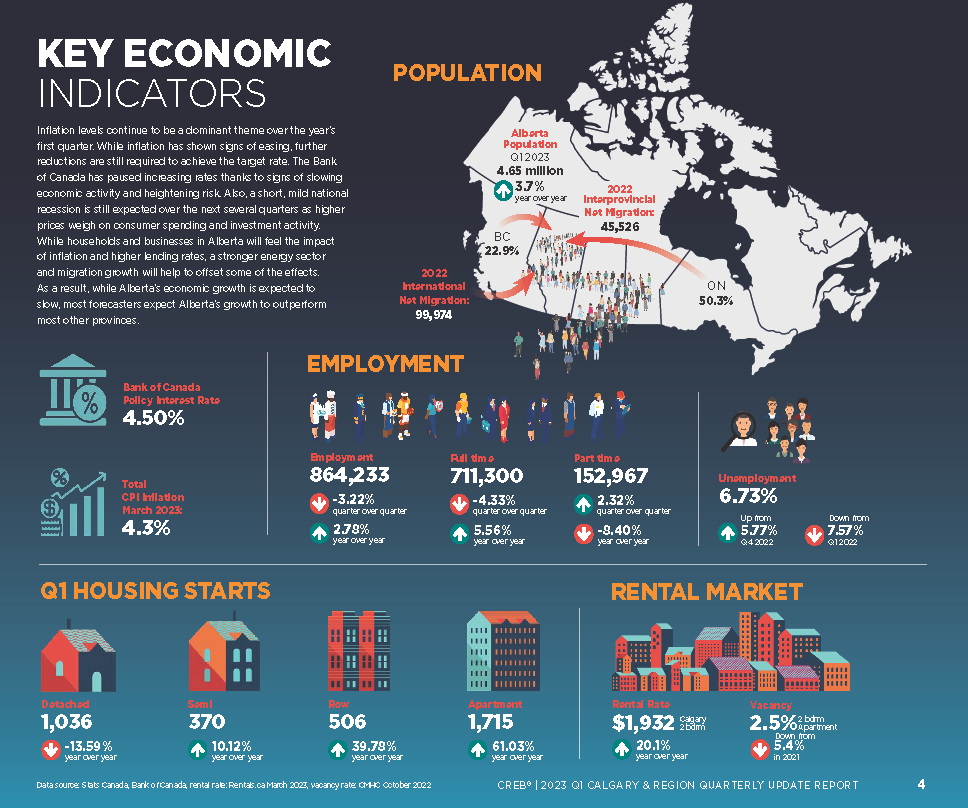

Economic Update

Inflation levels continue to be a dominant theme over the year’s first quarter. While inflation has shown signs of easing, further reductions are still required to achieve the target rate. The Bank of Canada has paused increasing rates thanks to signs of slowing economic activity and heightening risk. Also, a short, mild national recession is still expected over the next several quarters as higher prices weigh on consumer spending and investment activity. While households and businesses in Alberta will feel the impact of inflation and higher lending rates, a stronger energy sector and migration growth will help to offset some of the effects. As a result, while Alberta’s economic growth is expected to slow, most forecasters expect Alberta’s growth to outperform most other provinces.

Housing Market

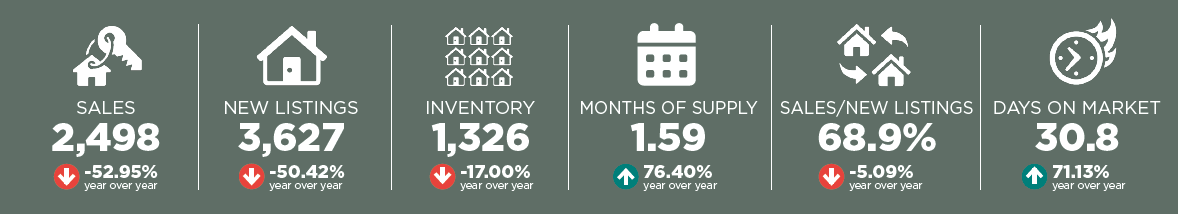

Detached

The biggest challenge in the detached market has been available supply in the lower price ranges. This is the only market segment where inventory has improved for homes over $700,000. Based on the first quarter benchmark price, the typical detached home is now priced at $636,167. This is a significant shift from a few years ago when detached benchmark prices were $550,000. This is causing a shift in sales toward more affordable property types like semi-detached, row and apartment condominiums. As of the first quarter, detached sales accounted for 47 per cent of all sales activity.

Semi-Detached

Like the detached sector, limited supply has weighed on activity in this market segment. As a result, inventory levels slowed in the first quarter compared to the end of 2022 and levels reported in the first quarter of last year.

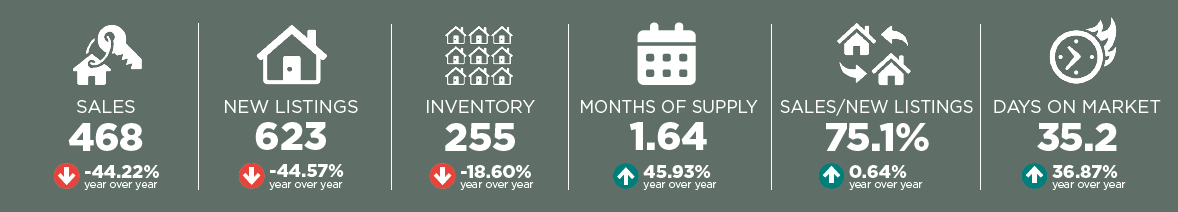

Row/Townhome

Relative affordability has drawn many purchasers to seek row/townhouse style properties. However, like the other property types, the supply levels have remained low compared to sales keeping conditions exceptionally tight. As a result, the months of supply and the sales-to-new listings ratio are similar to the levels reported at the start of 2022, causing prices to rise to a new quarterly record high of $369,733.

Apartment

While sales eased compared to last year, sales have remained slightly lower than the high levels seen in the previous year. This was possible as the pullback in new listings has been lower for apartment-style properties. Nonetheless, the strength in sales still prevents any significant shift in inventory levels which remain at levels not seen since 2014. In addition, the recent shift to seller’s market conditions has driven up prices. However, despite the recent shift, the quarterly benchmark price still remains below the highs reported in 2014.