The aftermath of the pandemic, along with geopolitical issues impacting global energy markets, has left many countries facing challenges with inflation and rising interest rates. The persistent inflation in 2022 has triggered significant rate hikes from the bank of Canada this year, moving from 0.25 percent at the start of the year to 4.25 percent by the end of 2022. These recent shifts are expected to weigh on consumers and businesses in 2023, causing the Canadian economy to slip into a recession. However, given the tight labour market and persistent supply chain issues in some sectors of the economy, the recession in Canada is expected to be mild and short-lived. The strength in commodities is expected to cushion some of the economic impacts that higher rates will have in Alberta.

While economic growth is expected to slow, forecasters are not calling for a recession in the province. At the same time, the strong flow of migrants to the province, along with job growth concentrated in generally higher-paid industries in Calgary, is expected to offset some of the impacts that higher lending rates are having on the housing market.

LENDING RATES & INFLATION

Easing inflationary pressure is expected in 2023, which should prevent any significant rate gains in 2023. While the depth and duration of a national recession can impact both lending rates and inflation, the Bank of Canada is not expected to lower overnight target rates until 2024. However, we could see a narrowing spread in mortgage lending rates before the end of 2023.

POPULATION

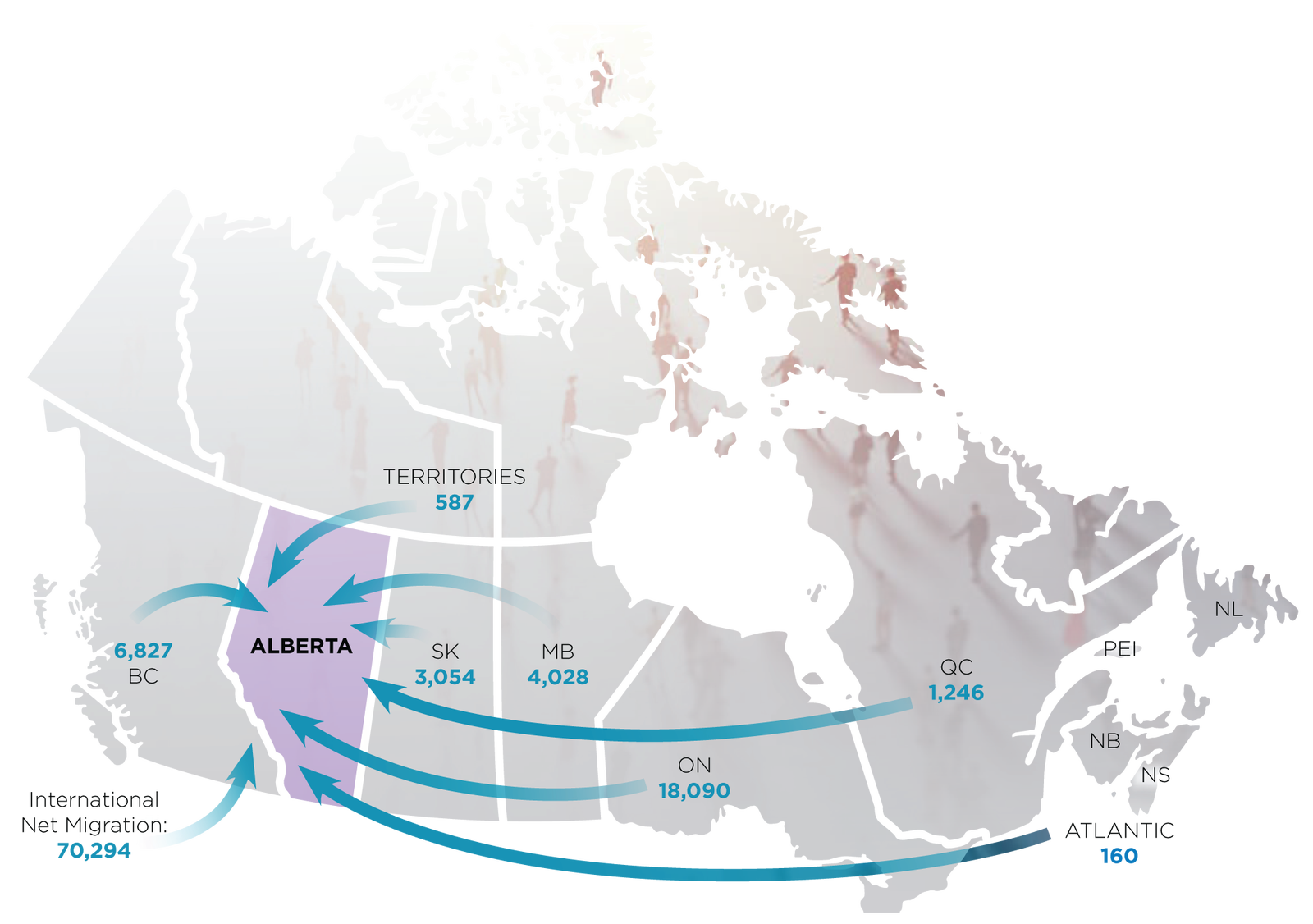

Over the first three quarters of 2022, Alberta saw a surge in both international and interprovincial migration contributing to tighter rental markets and ownership demand. Continued economic growth and relative affordability are expected to support elevated migration levels well into 2023. Much of the interprovincial migration has been driven by people moving from Ontario and BC to Alberta. The recent shift in migration is expected to help offset the impact of higher lending rates and support a housing market that is stronger than pre-COVID levels.

CREB® | 2023 FORECAST CALGARY & REGION YEARLY OUTLOOK REPORT

Source: Statistics Canada

EMPLOYMENT UPDATE

Source: Statistics Canada

EMPLOYMENT UPDATE

Calgary has seen the largest gain in employment in the province as it benefited not only from job growth related to the removal of COVID restrictions but also reported strong gains in professional, scientific, and technical jobs. Job growth is expected to slow in 2023 to one percent. However, previous gains in professional jobs and further gains in the sectors such as healthcare should continue to support a relatively stronger housing market.

Employment Growth: 1%

Unemployment Rate: 5.8%

Source: Conference Board of Canada

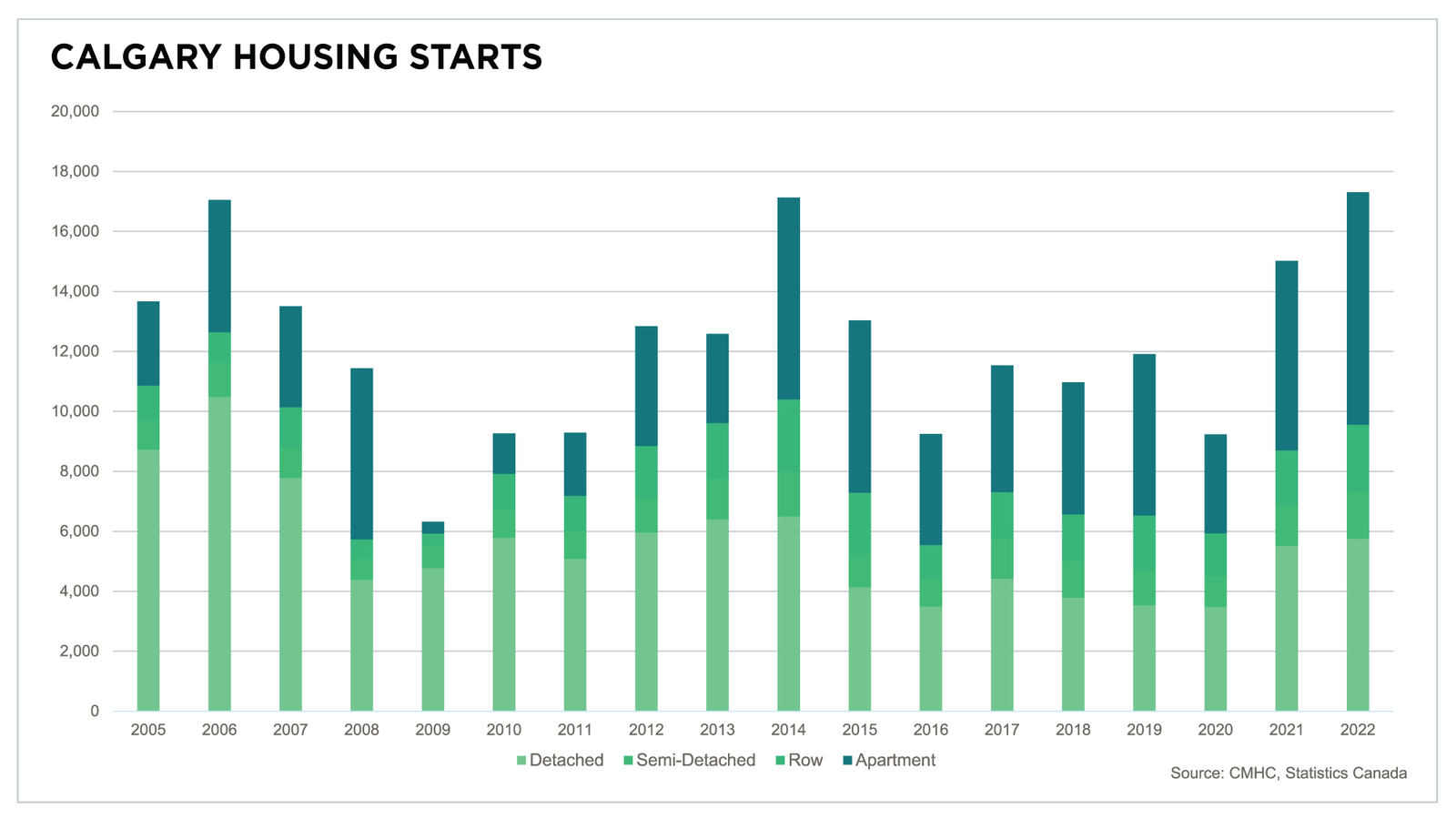

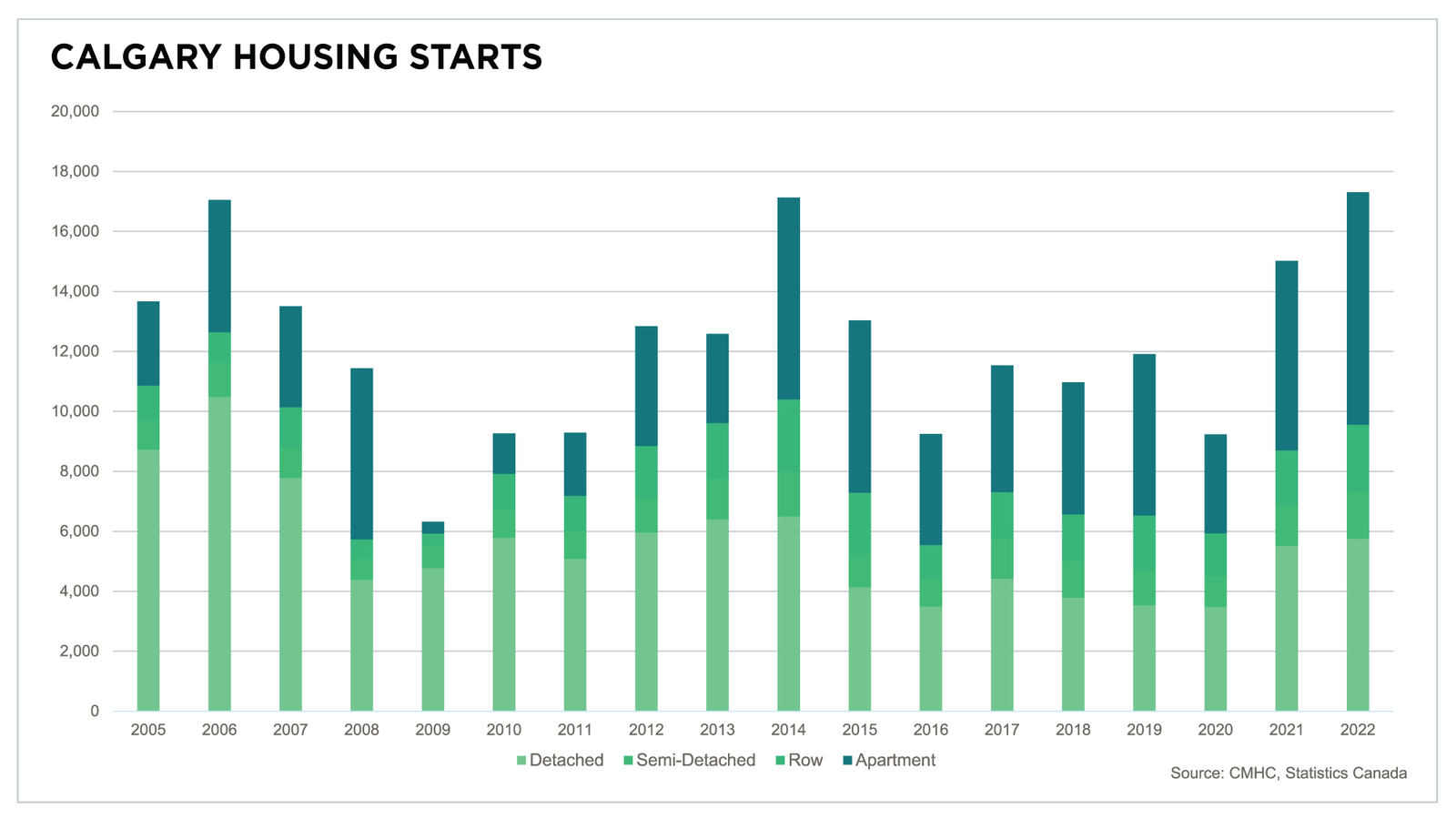

HOUSING SUPPLY

Calgary has not faced supply challenges for some time, but resale inventories ended in 2022 at the lowest levels seen since the pre-financial crisis in 2005. While some of the supply challenges are expected to be addressed by the new home sector, there is no indication that current construction levels relative to the population size will create a scenario where we will see too much supply come onto the market. This is especially the case with apartment-style products, where nearly half of the total starts this year are intended for the rental market. At the same time, new supply in the detached market tends to be at a higher price point providing limited supply relief for lower-priced detached homes. The larger concern is that the supply levels remain exceptionally low relative to demand which could prevent home prices from stabilizing this year.

HOW IS ALBERTA DIFFERENT?

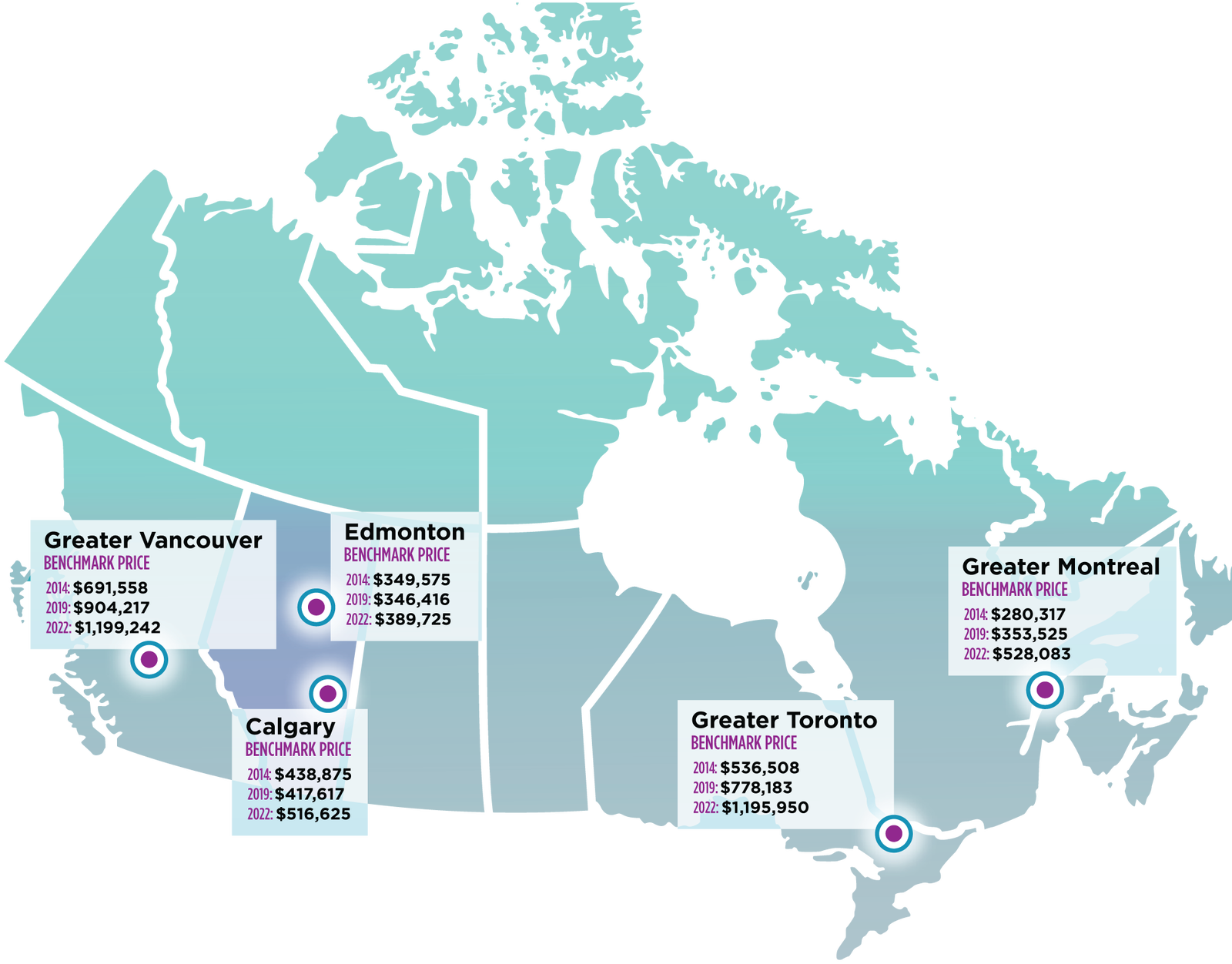

The pandemic and ultra-low lending rates contributed to a housing boom across the country. However, the price gains in Alberta were not as strong as in other parts of the country as we entered the pandemic with a market that favoured the buyer.

Before the pandemic, Alberta’s economy was struggling as the drop in energy prices in 2014 resulted in significant job loss, a loss of migrants and an economic contraction. By the end of 2019, home prices in Calgary and Edmonton were lower than the levels reported in 2014. Meanwhile, the country’s largest cities did not go through the same economic hardships, and over the five-year period, prices rose significantly over this time.

When the pandemic hit, those larger centres had less supply in their markets, and the sudden growth in demand caused price gains that were significantly higher than what was seen in our cities. Calgary home prices only recovered in 2021, and while supply challenges compared to demand did result in strong gains in 2022, over the pandemic period, price growth was still half of what was seen in other centres.

Recent rate gains have had more of an impact on home sales in Toronto and Vancouver. Slowing sales in these markets have impacted the national numbers prompting many to forecast price declines in Canada. It is also important to note that even with the forecasted price declines expected in the larger markets in the country, those declines are not expected to erase all the gains that occurred through the pandemic. While Calgary and Edmonton are not immune to the impacts of inflation and higher lending rates, they have not experienced the same level of price gains and are not expected to go through the same level of declines. Furthermore, thanks to higher commodity prices, a shift in interprovincial migration and relative affordability, Alberta is not expected to face the adjustments as other parts of the country.