Most homebuyers are not overly familiar with mortgage lingo or the differences between a fixed and variable interest rate, and they really don’t know which of the two is the best fit for them. The reality is that there is no right answer. Each buyer must make the decision that is right for them.

FIXED AND VARIABLE RATES

What are the key differences?Fixed rates are just that – fixed. This means that they do not change over the term of the mortgage. So, if a 5-year fixed rate mortgage is secured at 3%, then the interest rate of 3% is fixed for 5 years, meaning that mortgage payments will not change for 5 years. However, at the end of the 5-year term, the homeowner will need to renew their mortgage or obtain a new mortgage at whatever current rates are at the time of renewal. Fixed rates are typically quoted as a set number, i.e. “3%” or “3.5%”.

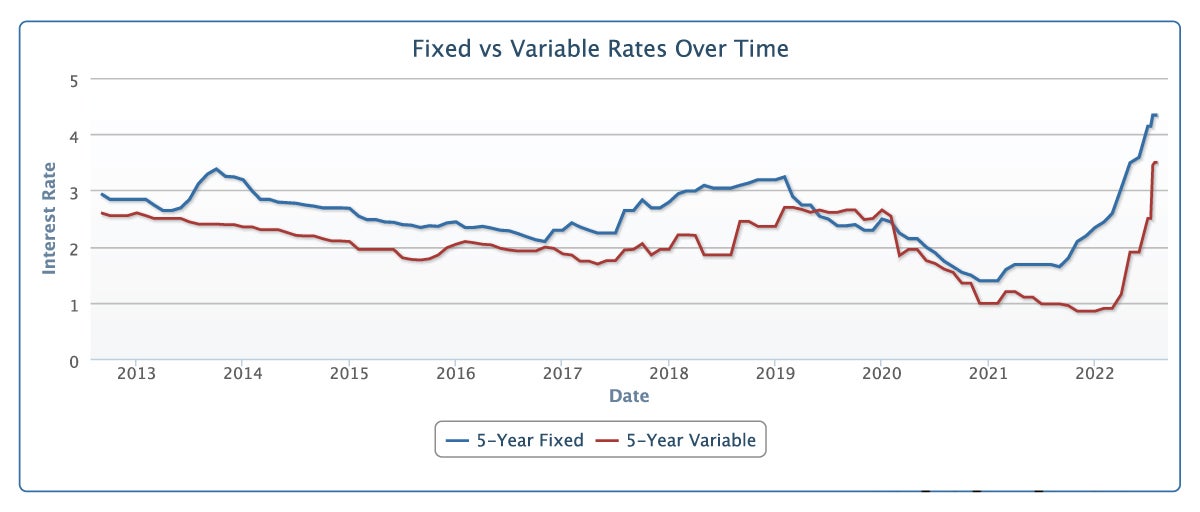

Variable rates fluctuate throughout the course of the mortgage term, along with any changes to prime. As the prime rate can go up or down over the mortgage term, the mortgage interest rate can also go up or down, which typically means that the mortgage payment will also go up or down. All these changes are directly tied to changes in the prime lending rate set by the bank of Canada 8 times per year. Like fixed rates, at the end of the mortgage term (usually 3-5 years), a homeowner must renew or obtain a new mortgage at whatever current rates are at the time of renewal. Variable rates are typically quoted in terms of their difference to the prime rate, such as “prime minus 0.5%” or “prime plus 0.2%”.

QUALIFYING FOR A FIXED VS. VARIABLE RATE MORTGAGE

Since 2018, all Canadian homebuyers looking to secure a mortgage must undergo a “mortgage stress test,” regardless of their down payment amount. This mortgage stress test is meant to ensure that Canadians obtaining loans in a low interest-rate environment will still be able to afford their mortgage payments should interest rates be higher when they renew their loan in the future.

In general, the stress test says that a homebuyer must qualify for their mortgage at either the set minimum qualifying rate or their quoted rate plus 2%, whichever is higher. The set minimum rate can change over time. Since July 2021, it has been 5.25%.

Whether or not a buyer would qualify for a different mortgage amount depending on whether they were going with a fixed or a variable rate depends on the fixed or variable rate at the time of obtaining the mortgage.

When both variable and fixed rates were at historic lows during the pandemic in 2020-2021, most homebuyers were qualifying at 5.25% as both fixed and variable rates were well below 3.25%.

However, in early 2022, when fixed rates rose faster than variable rates, homebuyers looking to secure a fixed rate had to qualify at their posted rate plus 2%, which meant many fixed rate borrowers were qualifying at rates between 6-7%. During this same period, variable rates were still low enough that variable rate borrowers could continue to qualify at 5.25%.

With the most recent change to prime in July 2022, variable rates are now high enough that variable rate borrowers have to qualify at their quoted rate plus 2%, the same as their fixed-rate peers. Effectively, this has made the stress test for fixed-rate loans between 6.5-7%, while the stress test for variable rate loans is sitting between 5.5-6%.

How this changes in the future, well, that is yet to be seen!

THE CASE FOR CHOOSING A FIXED RATE

What is the main reason for choosing a fixed rate? Peace of Mind. A homeowner taking a fixed rate loan knows that their mortgage payment will not change for 5 years. It can be very stressful for many homeowners with variable-rate mortgages if the prime rate rises, or there is talk of this coming down the pipes.

THE CASE FOR CHOOSING A VARIABLE RATE

What is the main reason for choosing a variable rate? Lower interest rates. Historically, selecting a variable rate has proven cheaper over the long run, as the variable rate often starts well below the fixed rate offered simultaneously. This means that a borrower can benefit from a lower rate right out of the gate, and even if interest rates rise, it usually takes time for a variable rate to catch up to what their fixed rate would have been. And if interest rates fall? Well, those with a variable rate are laughing all the way to the bank. For those who tolerate risk well, a variable rate loan has proven a smart move, at least in recent years when interest rates have been falling rather than rising. Now that we are in a rising interest rate environment, whether a variable rate comes out on top over the term of the mortgage will depend on how fast rates rise and how long they stay elevated. On other benefit of a variable rate? You can typically lock in to a fixed rate at any time over the course of the loan if your nerves get the best of you, or you anticipate rates to start rising.

SO? SHOULD I GO WITH A VARIABLE RATE OR A FIXED RATE?

That’s a tricky question and really is a personal choice. In general, if you couldn’t live with the stress of knowing your payments may go up during the term of your mortgage, then choosing a fixed rate is probably your best bet. However, if you are tolerant of risk and don’t believe that increases to prime will be more than the current spread of fixed to variable rates or won’t stay elevated for long, then going with a variable rate may pay off for you over the long run. Either way, it’s best to speak with your mortgage rep to ensure you are getting all the most current information you need to make the right decision!

If you don’t have a mortgage rep you are working with that you trust, don’t hesitate to reach out for some recommendations!